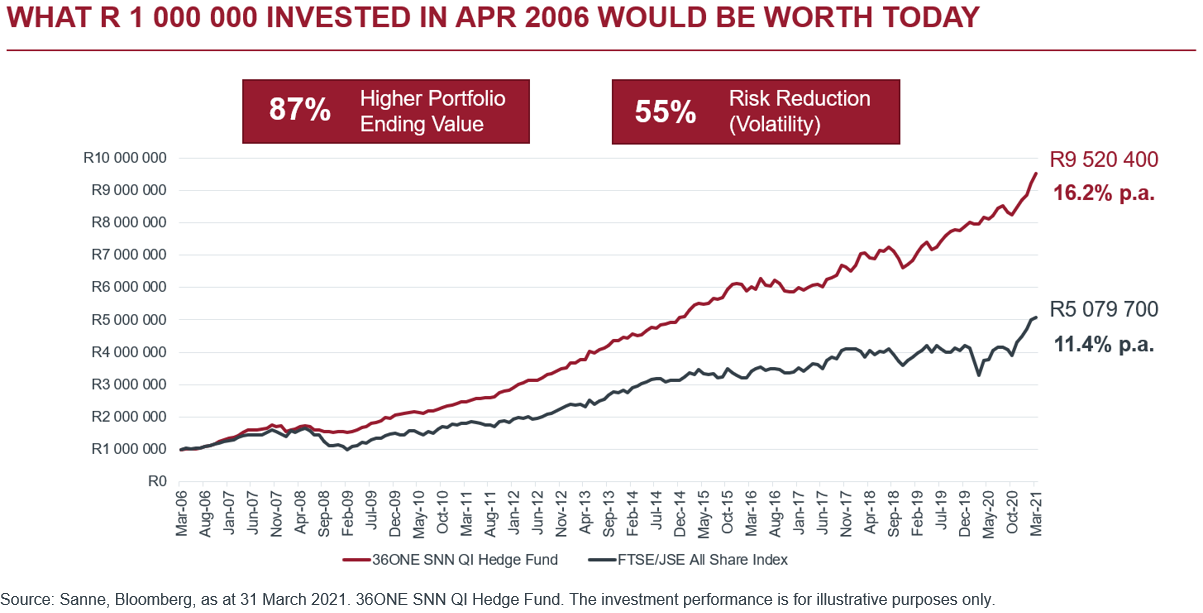

The 36ONE SNN QI Hedge Fund celebrated its 15-year anniversary on 1 April 2021. The industry looks vastly different today to how it looked one-and-a-half decades ago, but investors continue to need well-diversified funds that can meet their needs through changing market cycles. The 36ONE Hedge Funds continue to be a great option for investors looking for long-term growth, but who want to take on less risk than they would with a traditional equity or balanced fund. Importantly, one of its key characteristics is that it aims to protect investors when markets are falling.

Our primary hedge funds are the 36ONE SNN QI Hedge Fund (QIHF) and the 36ONE SNN Retail Hedge Fund (RIHF).

1. What are the main differences between these two funds?

In terms of investment strategy, the two are mirrors of one another. Key differences include:

| 36ONE QIHF | 36ONE RIHF | |

|---|---|---|

| Investor type | Available to qualified investors | Available to all investors |

| Inception date | 01 April 2006 | 01 December 2008 01 November 2016 (CISCA inception) |

| Investment minimums | R1 000 000 (regulation stipulated) | Lower investment minimums, dependent on provider |

| Frequency of liquidity and pricing | Monthly | Daily |

2. What is an equity long/short strategy?

This strategy predominantly generates its returns from positions in equity markets. This style of investing has historically produced equity-like returns with substantially less volatility than traditional equity unit trust strategies over the long term. The 36ONE QIHF has returned on average 16% p.a. since its inception after fees. Importantly, not only has the volatility been 55% lower compared to the market (ALSI), but it has also experienced much lower drawdowns during the period.

3. What do these funds invest in?

These funds are diversified and invest in South African and offshore equity markets, as well as other financial instruments (such as cash and derivatives) to enhance returns and, importantly, to manage risk.

4. What are the objectives and who is best suited for these funds?

Capital preservation is key to these funds’ objectives. They aim to outperform cash and generate absolute returns over the long term, regardless of market direction. Investors looking to grow their capital in real terms over time, while significantly reducing the volatility associated with investing in equities, are best suited for these funds.

5. Are they available in retirement products? Yes, Regulation 28 allows for a maximum of 10% in total to be allocated to hedge funds. We believe that hedge funds should form part of an investor’s investment portfolio, as a diversified portfolio limits the risk of permanent capital loss and maximises the probability of real returns over the long term.

6. A few benefits of investing in these funds include:

Increased diversification: The bi-directional strategy (from the long and short positions combined) means that we can generate returns in both upward and downward trending equity markets. The ability to go long and short broadens the portfolios’ ability to exploit a larger opportunity set.

Additional sources of alpha: A further source of revenue that shorting introduces is upfront cash (through the sale of the borrowed security). This cash can either be deployed to buy more securities or simply used to earn interest, which is then reinvested in the fund (the interest earned on the cash is far larger than the small fee the manager pays to borrow the security).

Improved risk-return profile: Not only can these funds generate profits from their long and short positions, but the short positions act to reduce market exposure. This can provide an element of protection (or hedge) when markets decline because the gains on short positions will offset the losses on long positions.

Improved portfolio longevity: Our funds can reduce portfolio volatility and, in turn, play a role in keeping clients invested through market cycles, due to substantially lower drawdowns.

7. Fund accessibility

The 36ONE RIHF is available via Sanne (our Manco) and via certain LISP platforms. For more information on how to access our funds, please contact us.

Disclaimer:

Bloomberg, Sanne as at 31 March 2021. Past Performance is not necessarily an indication of future performance. 36ONE SNN QI Hedge Fund CISCA inception date is 01 November 2016. Sanne Management Company is registered and approved by the FSCA under CISCA, and retains full legal responsibility for the third-party-named portfolio. 36ONE SNN QI Hedge Fund highest and lowest rolling 12-month performance since inception: High 58.63%; Low -10.84%. 36ONE RIHF highest and lowest rolling 12 month performance since inception: High 18.84%; Low -2.01%. See our full disclaimer here. 36ONE Asset Management Pty Ltd is a licensed financial service provider. FSP# 19107