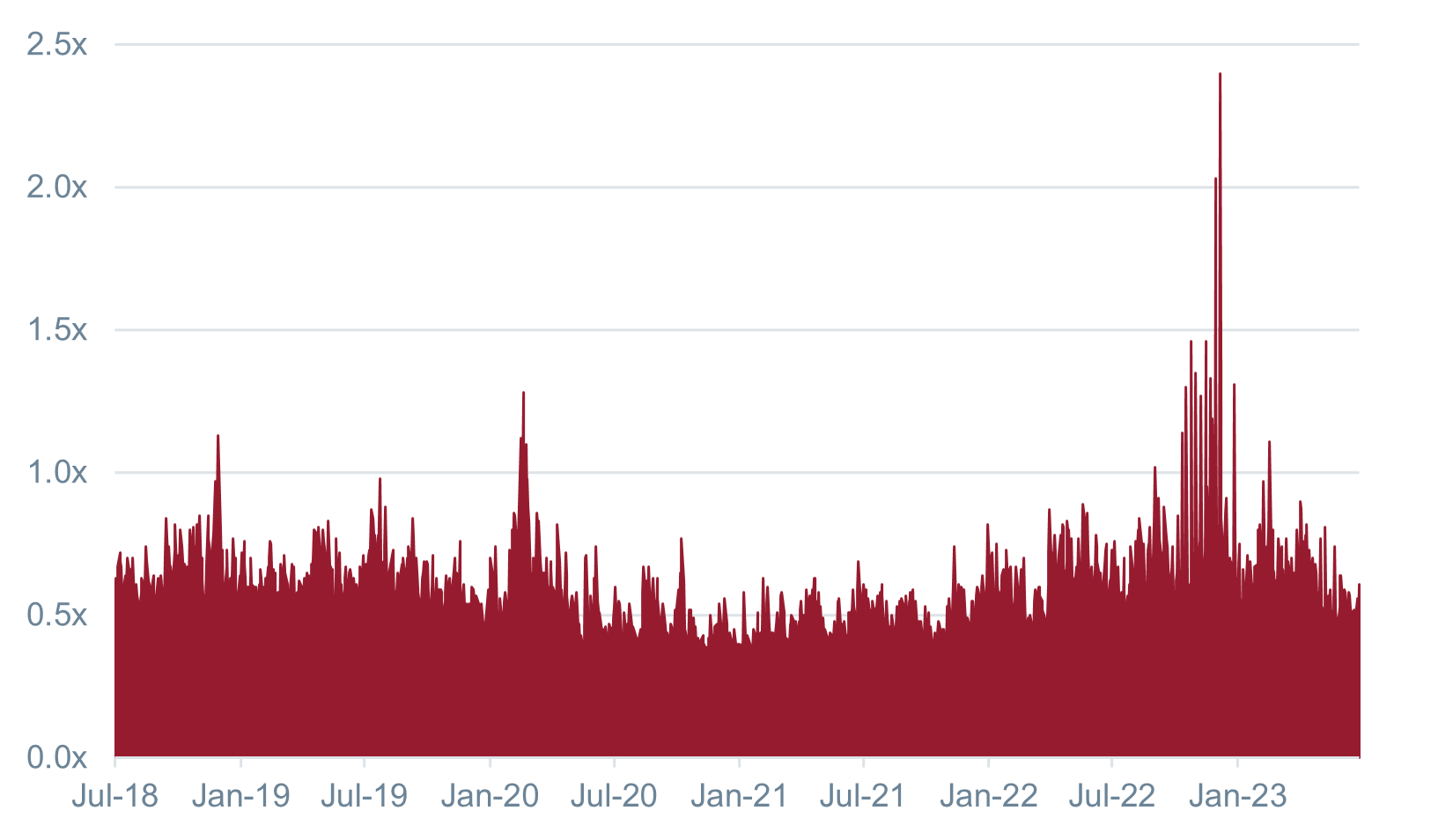

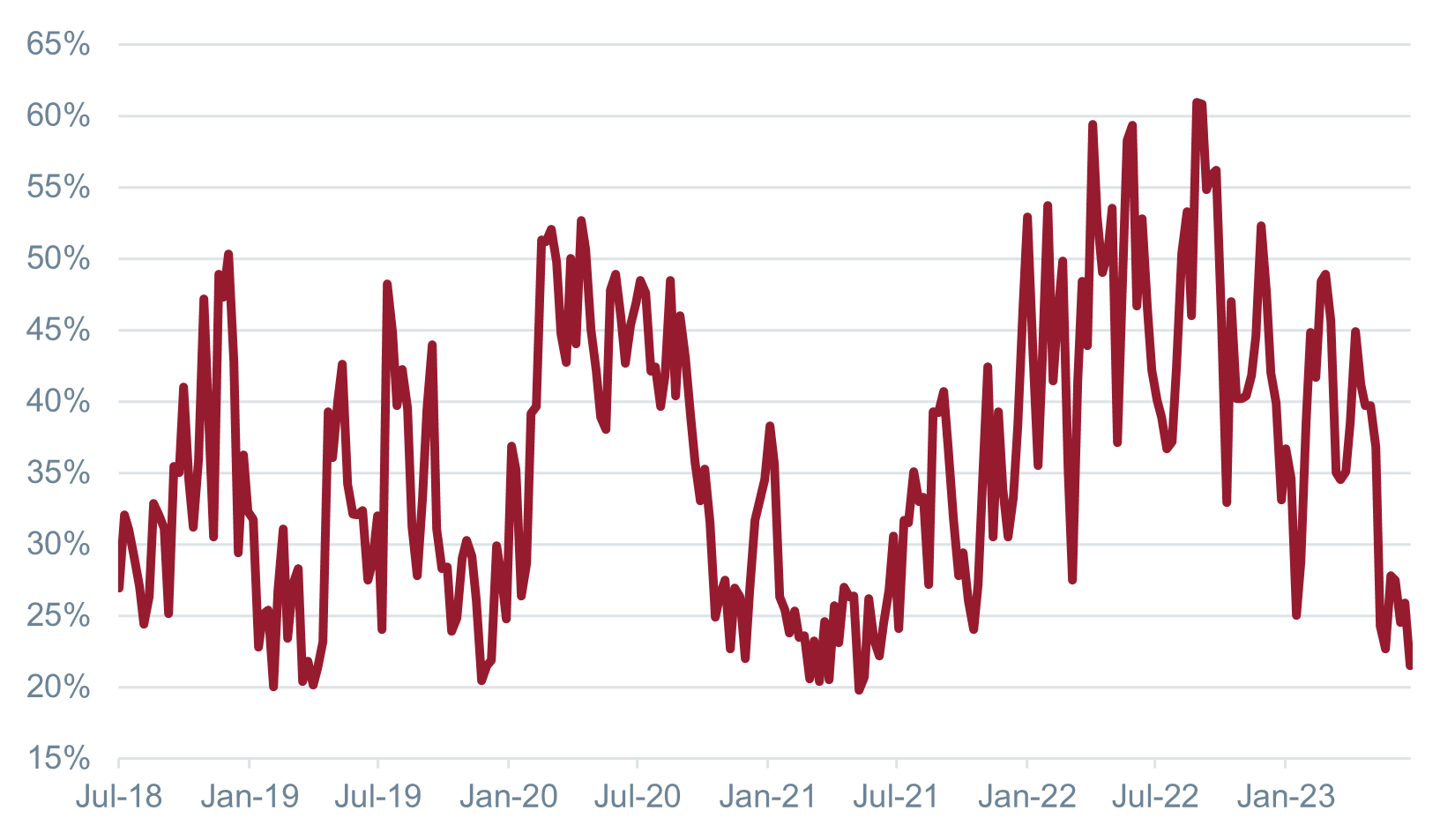

At the start of the year, numerous equity strategists released their “Year Ahead” reports, where in some instances, came just short of prophesying Armageddon. The overwhelming majority believed that high interest rates and stubborn inflation would weigh on consumers and eat into corporate profits. The market shared the view as can be seen from positioning and sentiment at the end of 2022/ start of 2023 (Exhibit 1 and Exhibit 2).

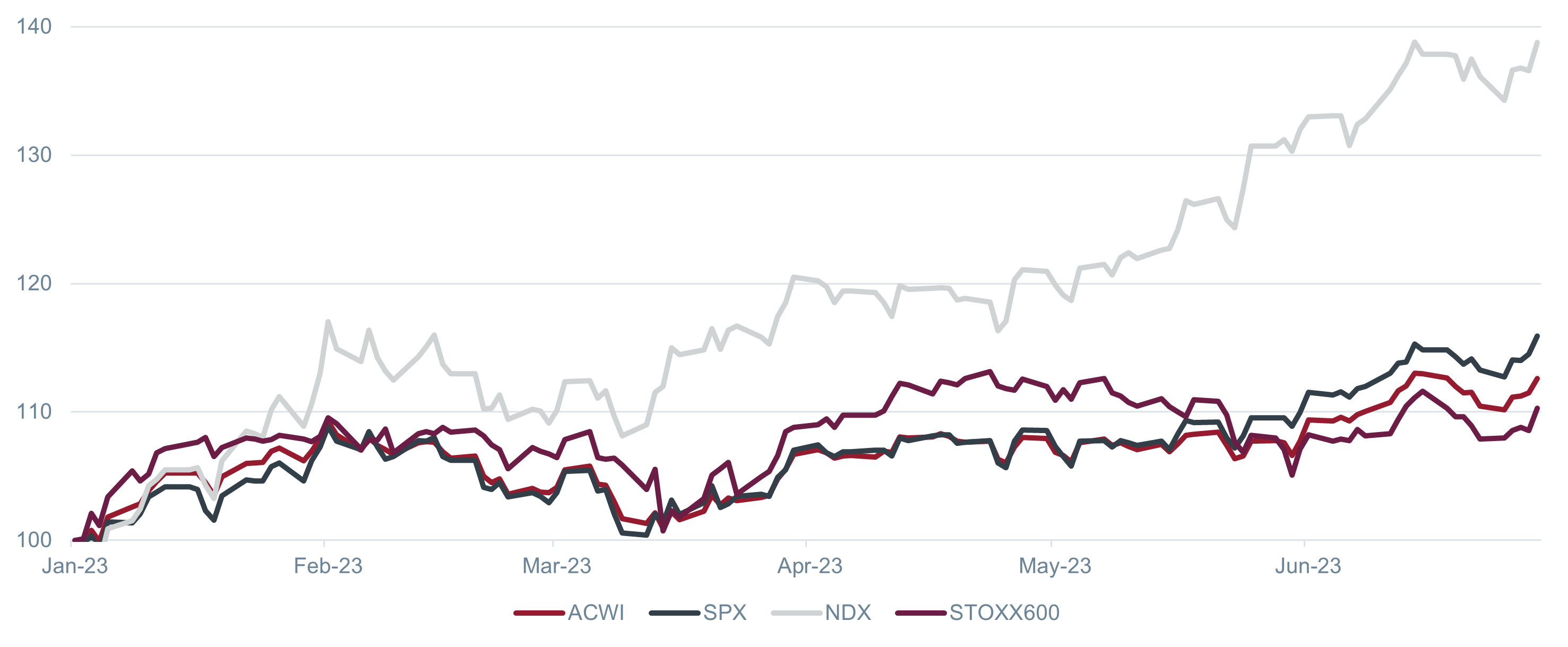

What transpired, however, is that the MSCI All Countries World Index (ACWI) and the S&P500 Index (SPX) rose 14% and 16% respectively during the first half of the year. The regional bank crisis was shrugged off as the US labour market proved resilient and Artificial Intelligence became the new buzzword. What this has shown is what happens when positioning is heavily skewed to one side. In the short term, extreme positioning can lead to violent moves in the opposite direction.

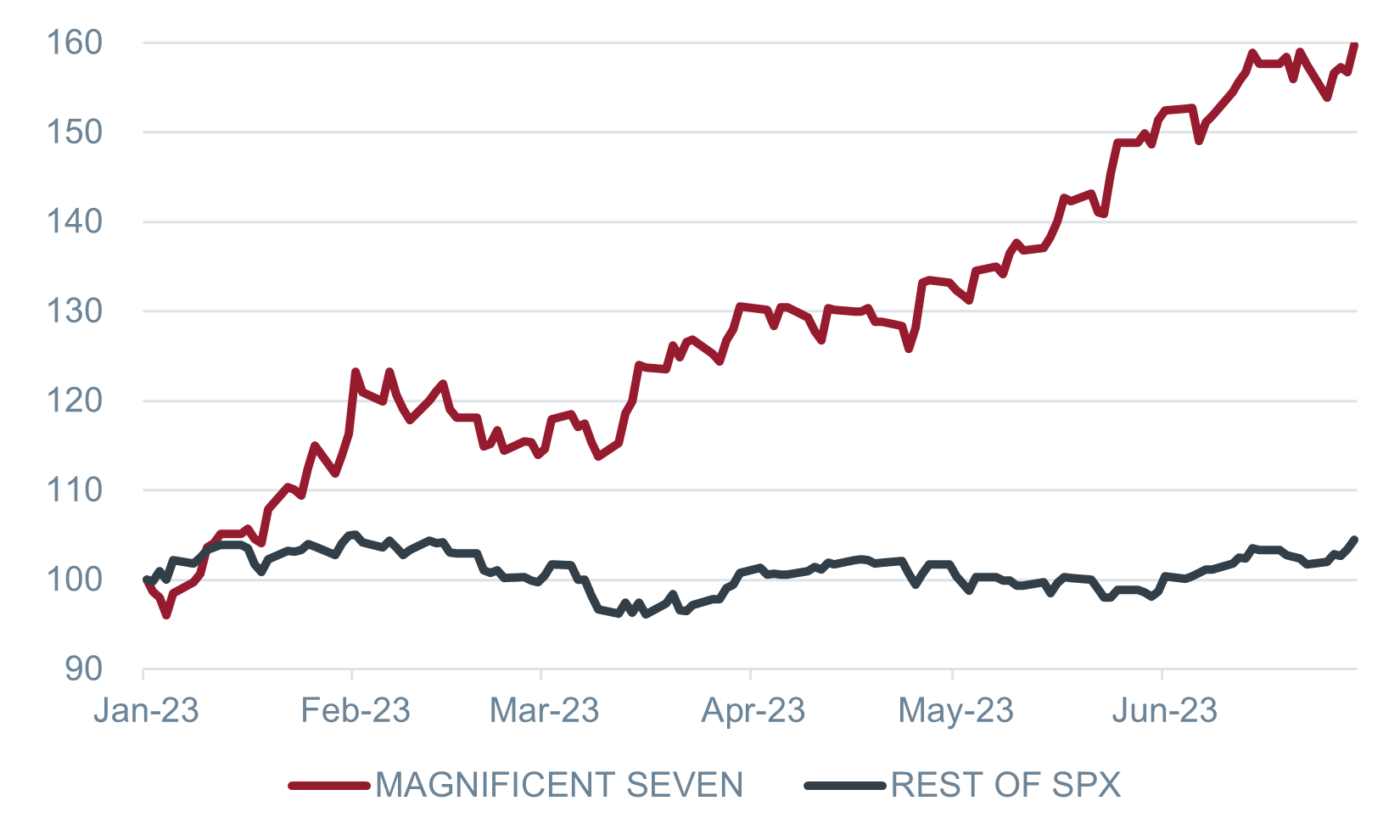

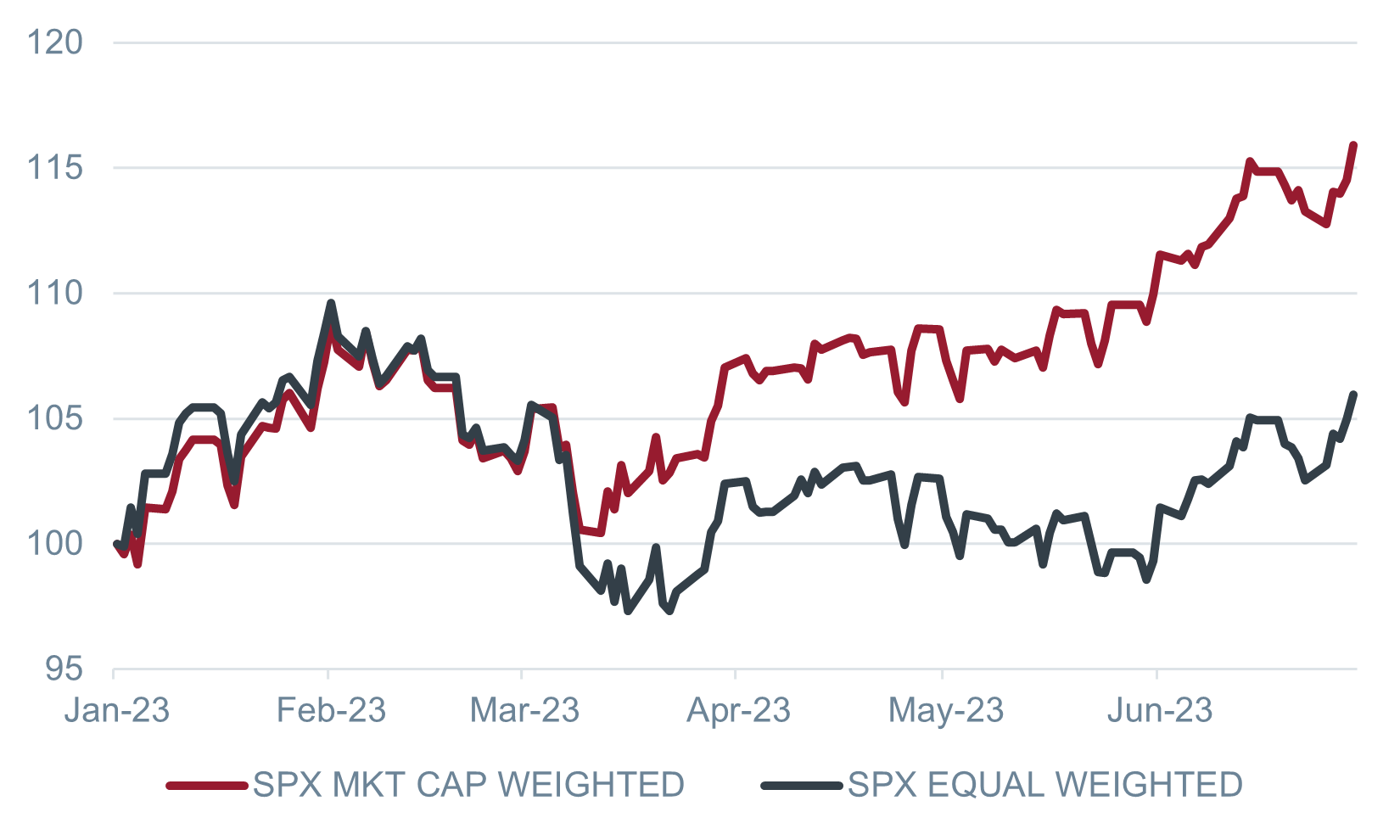

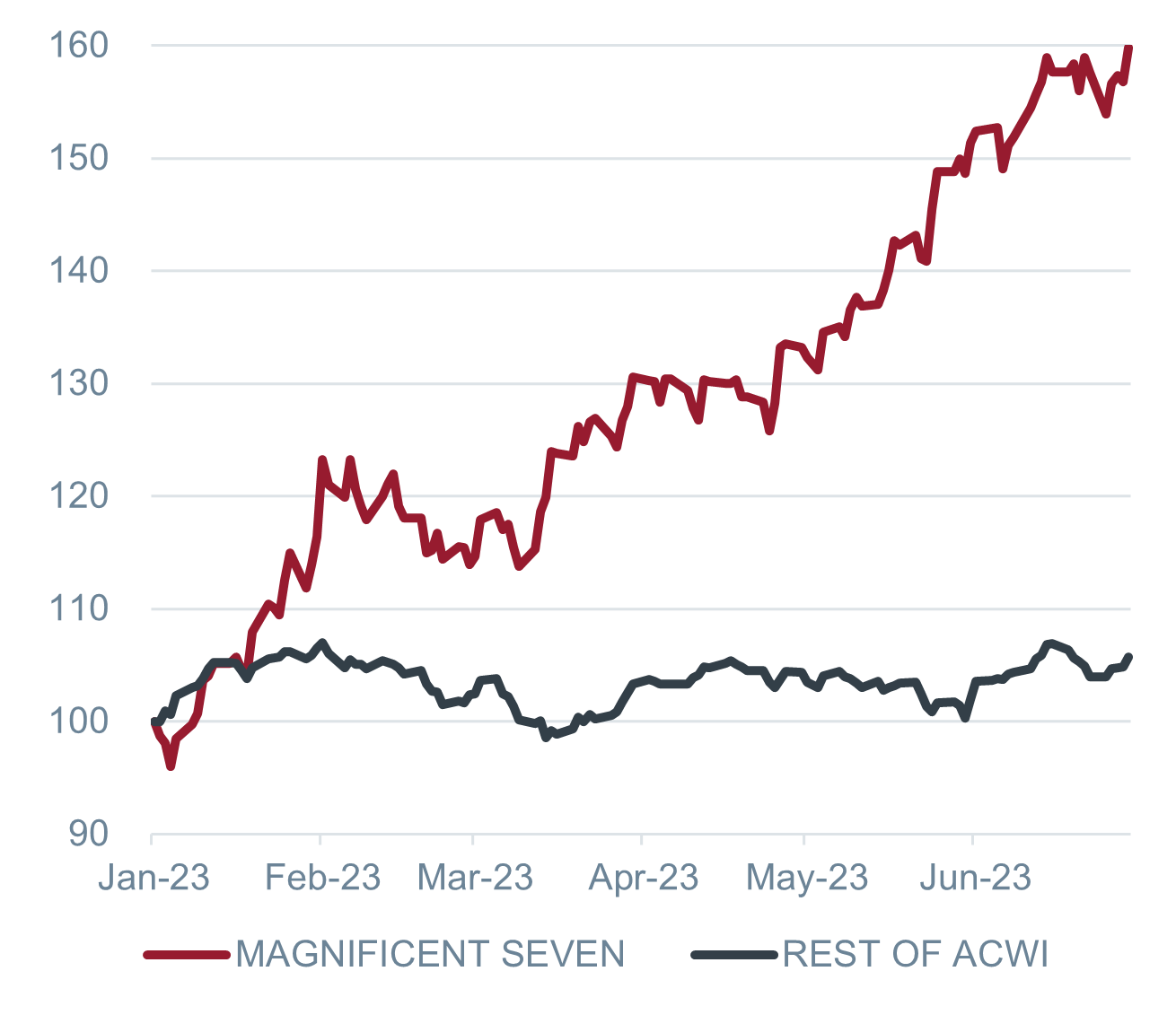

A closer look at the returns on the SPX shows that there are a handful of stocks that have underpinned the betterthan-expected returns. Market commentators, probably feeling some nostalgia from a time gone by when Westerns were popular, have dubbed these stocks as the “magnificent seven”. These seven stocks contributed about 78% of the SPX’s gains in 1H23 and have significantly outperformed the rest of the index (Exhibit 5). This concentration is further illustrated by the market cap weighted SPX outperforming the equal weighted SPX (Exhibit 6) since the first quarter.

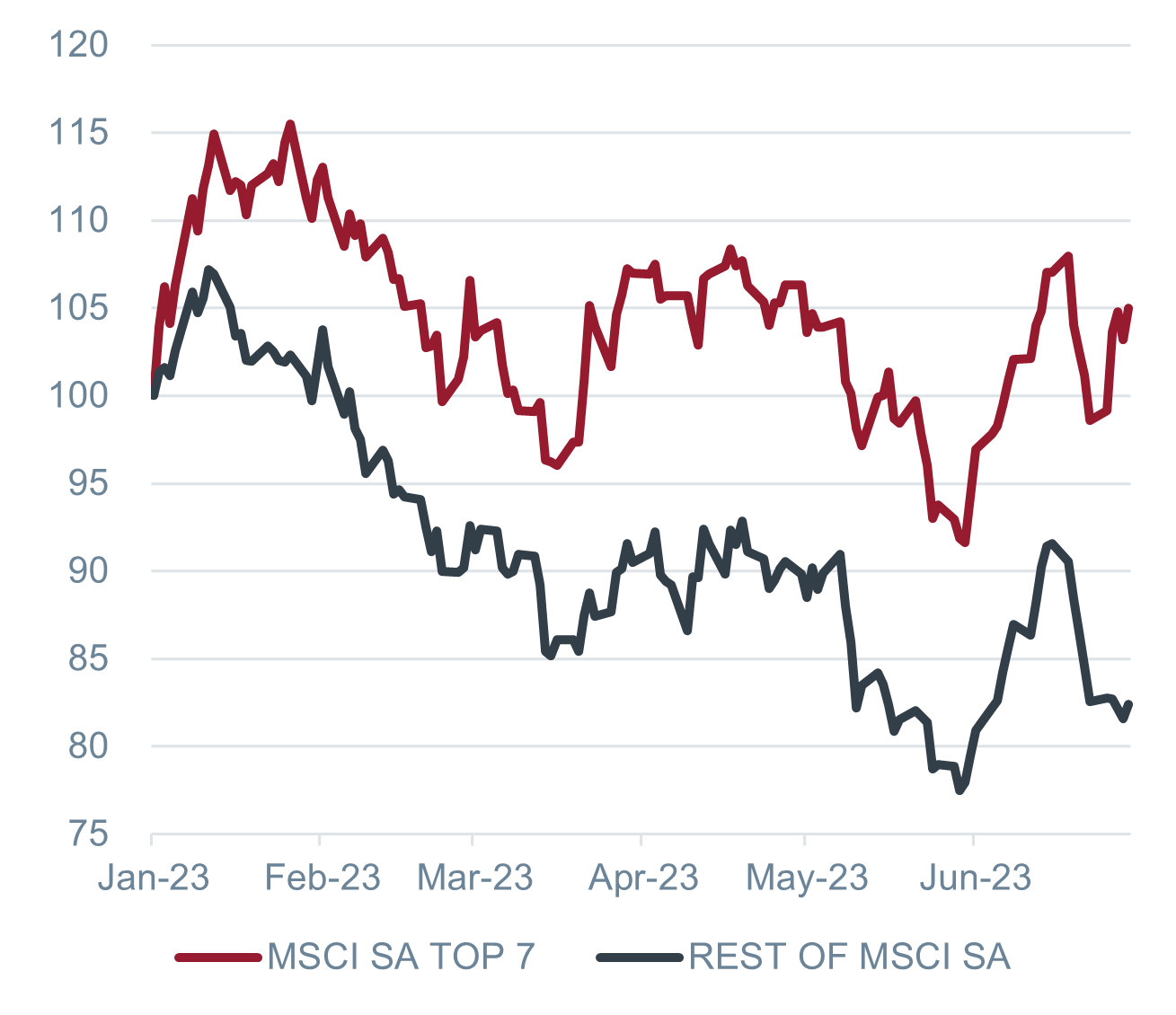

The ACWI, considered one of the largest and most diversified indices in the world, has also not escaped the “magnificent seven” influence (Exhibit 7). We estimate over half of its gains in 2023 are attributed to the “magnificent seven”. When looking at indices that do not have the “magnificent seven”, we see that the top seven constituents do not show as much dispersion (Exhibit 8 and Exhibit 9).

Concentration risk refers to the potential risk that arises from having a significant portion of a portfolio allocated to a particular asset, sector, industry, or geographic region. One of the fundamental pillars of long-term investing is that of diversification. A well-diversified portfolio allows investors to protect capital in times of market downturns and lowers risk.

Part of the reason many investors invest in passive funds that track major equity indices is to achieve diversification at low cost. This is brought into question when only a few stocks are driving most of the gains of a major equity index. Due to the small number of these stocks, gains can quickly reverse.

If one looks at 2022, the SPX fell 21% but the “magnificent seven” lost 43% in value, while the rest of the market fell by only 12%. The journey between 2022 and 2023 highlights the risk and volatility that concentration can present. A further problem that arises from concentration, is that it can mask the overall health of the market or economy, luring investors into a false sense of security.

The “magnificent seven” are currently trading on a price to trailing earnings ratio of 40x vs. the SPX excluding them, of around 15x. This is indicative of potential opportunities in the rest of the market of stocks that have essentially been left behind. Arguably, it is through an active strategy that these opportunities can be appropriately identified and capitalised upon. It is the contention of this author that diversification can be achieved the best through active management.