US markets have not had any major IPOs since the Federal Reserve (Fed) started raising rates aggressively in March 2022. The market has been contending with these higher rates, an increasingly uncertain growth outlook and higher geopolitical risk. These factors have understandably made both private companies and public market investors wary of new listings. As we now appear to be reaching the end of the Fed’s hiking cycle, we are beginning to see some major IPOs coming to market. Could this be a turnaround in the lacklustre IPO market?

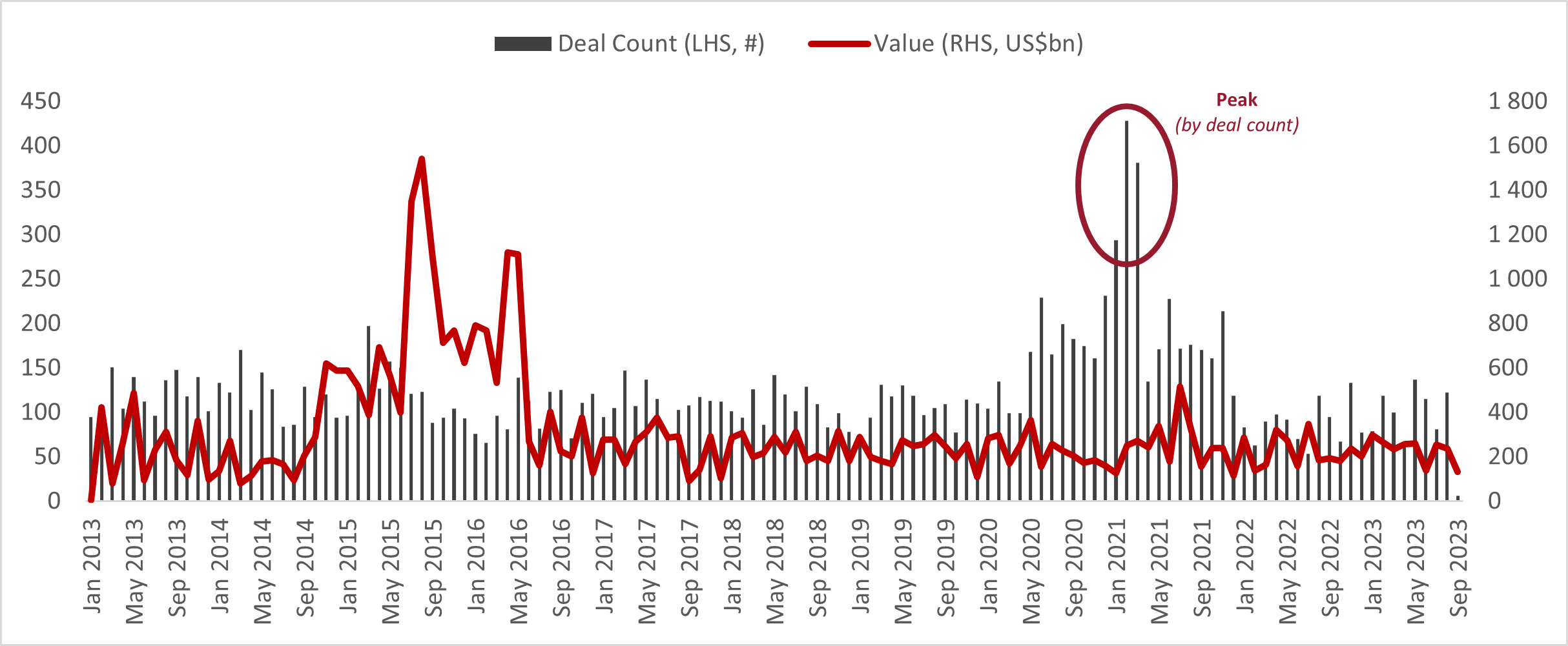

As shown above, the number of IPOs peaked in 2021. This year has, so far, had few notable listings. Standouts in 2023 include Cava Group (US$5bn market cap) and Kenvue Inc. (US$44bn market cap). Cava owns and operates fast casual Mediterranean restaurants and has almost doubled its share price since its IPO in June. The company has capitalised on consumers choosing to be healthier and eating out as we reach the tail end of post-Covid lockdown “revenge spending”. Kenvue was spun out of Johnson and Johnson (J&J). The company is a consumer staples firm housing brands such as Listerine, Neutrogena, and Band-Aid. Kenvue‘s share price has been flat since its listing in May, negatively impacted by consumers trading down and an overhang as J&J may place more shares in the market.

There are other rumoured major IPOs like Birkenstock and a recent filing by Instacart. However, what clearly stands out is the lack of major technology IPOs after we saw notable companies like Palantir (US$33bn) and Berkshire Hathaway-backed Snowflake (US$52bn) listing in the last few years. The listing of chip designer, Arm, could change that.

Arm is an integral player in global technology and designs the architecture of chips found in 99% of smartphones. The company was acquired by SoftBank in 2016 for $32bn and is reportedly looking to list at a valuation of up to $52bn. The IPO is likely to have the backing of some of Arm’s largest customers. This list includes Nvidia, AMD, Intel and Samsung Electronics. This listing would be significant and, if successful, likely encourage other major companies to follow suit.

When looking at the South African IPO market, the picture is a bit more challenging. The JSE has become smaller over the last few years, and we’ve seen South African equities trading at a discount to other emerging markets. This doesn’t make for an ideal listing environment. These conditions didn’t deter Premier Group (R7.7bn market cap) which listed this year, described as the first major IPO since 2018. However, we’ve seen a few notable IPOs delayed, including Coca-Cola Beverages Africa and Fidelity Services Group.

We continue to watch these developments as more opportunities to diversify into different companies is a benefit for our investors and entrepreneurs can benefit from the liquidity of public markets. It is still too early to call a coming boom in the IPO market, but we may have reached the bottom.