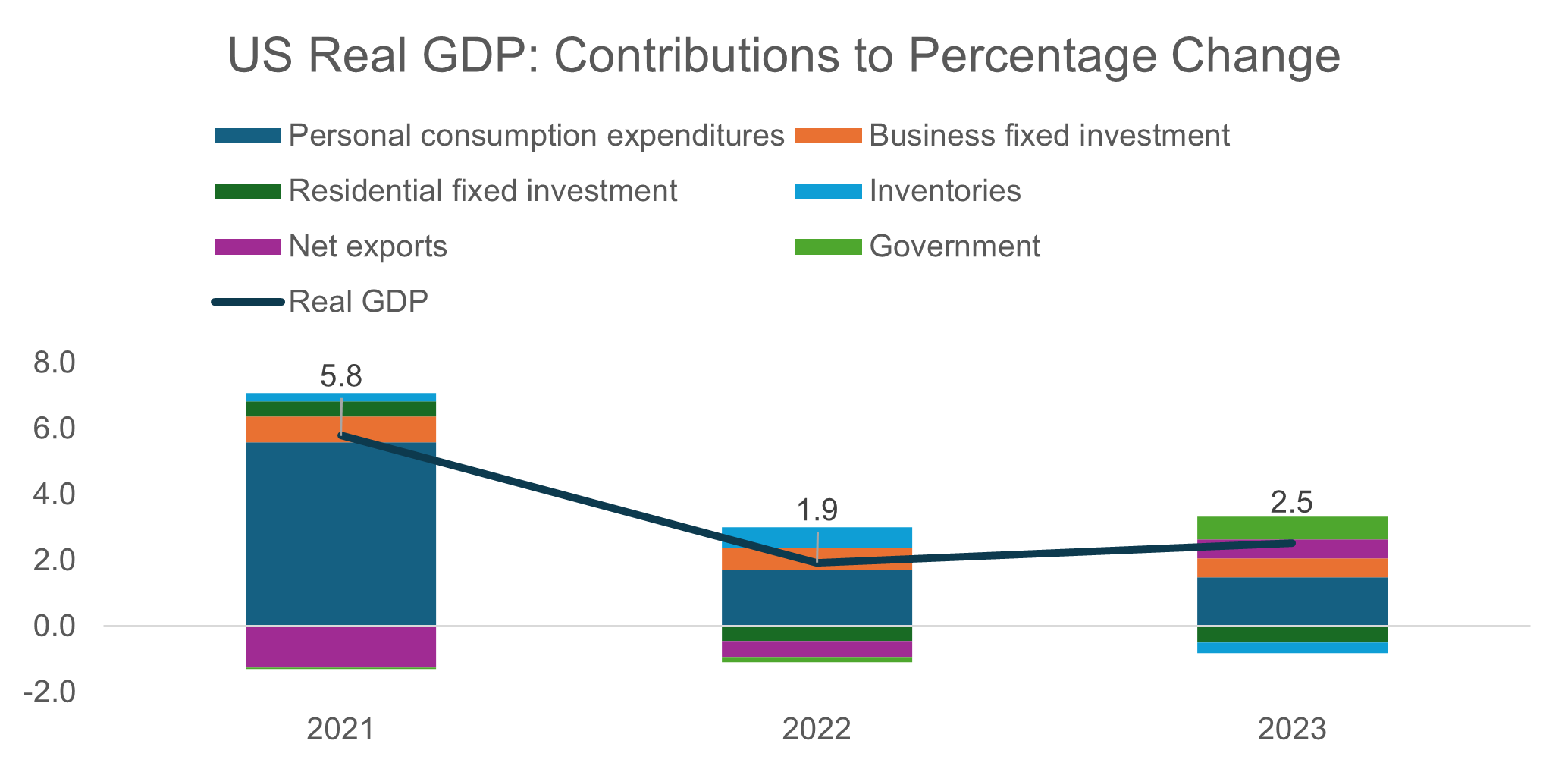

One of the major market surprises in 2023 was the resilience of the US economy. A recession was avoided in 2023, despite record interest rate hikes. As we enter 2024, the market is now expecting a soft landing as US growth remains robust. One of the drivers explaining this outperformance is the generous fiscal stimulus and programs which have been implemented by the US government as the economy reopened following the lockdowns in response to the Covid-19 pandemic.

The positive impact of fiscal support to consumers, including direct payments and suspension of debt repayments, has been well understood. The other type of fiscal support which is now receiving more attention is that provided to businesses and implemented to encourage investment in the economy.

Following lockdowns, the US government signed significant pieces of legislation to encourage the private sector to invest in the economy. Under normal circumstances, a high interest rate environment (such as the current one) would encourage companies to cut back their investment and focus on paying down debt in anticipation of an economic slowdown. Effective fiscal policy counteracts this by incentivising investment through subsidies, tax breaks and other such measures. The current fiscal programs have incentivised companies to bring forward capital expenditure, despite recession fears.

The three major industrial policies which have been implemented in the last few years are:

- Infrastructure Investment and Jobs Act, 2021 (IIJA): $1.2 trillion in federal spending over five years, including $550 billion of new investment;

- Inflation Reduction Act, 2022 (IRA): $891 billion in spending over ten years, including $783 billion on energy and climate; and

- CHIPS and Science Act, 2022 (CHIPS Act): encouraging local investment in semiconductors.

Each of these pieces of industrial policy has specific programs that either provide tax incentives (such as the tax credit transferability in the IRA); or encourage further investment (such as the domestic component requirement in the IRA) and subsidies (such as encouraging onshore investment in semiconductors).

This fiscal policy has been critical in supporting US growth. However, it does come with some concerns. Unconstrained fiscal policy has the risk of resulting in higher inflation, and elevated debt levels. The current high interest rate environment has mitigated the impact on inflation but exacerbated the effects of higher debt. In our view, the US has managed to strike a delicate balance through an interplay of fiscal and monetary policies over the medium term.

This strong economy leaves the Federal Reserve in a difficult position. Inflation is decelerating but is not yet at their target rate. Cutting interest rates too soon could heighten inflation risks, posing a threat to economic stability. The members of the Federal Open Market Committee, which sets interest rates, have been cautious in their speech in the last few months and the market has had to dial back their expectations of the timing of interest rate cuts. As indicated by the Fed taking March cuts off the table, the strong US economy gives no fundamental reason for the Fed to cut rates too early.