Naspers was founded in 1915 as a newspaper and magazine publishing house. Since its listing on the JSE in 1994, it has become a global media company focusing on technology and internet channels. Naspers was able to use the strong cash generations of its media assets to diversify the group. The most notable one being Tencent. They acquired a 46.5% stake in 2001 for a mere $32m. After divesting a portion in March 2018, for around $10bn, their holding is still valued at over $200bn. As at the end of July 2020, Naspers plus their unbundling of Prosus and MultiChoice represent c. 23% of the entire JSE value. Since 2014, the All Share Index is up c. 20.5%, but excluding Naspers and Prosus it is down c. 2.7%. It is evident that the actions of Naspers were instrumental in furthering the retirement and asset management industry in SA. Maybe even the ‘goose that laid the golden egg’.

Where to now though? Could our gold mining industry be a bastion of hope after the prior tumultuous years that the general market in SA has undergone? Since the beginning of 2018, when SA Inc. started to show real weakness after years of corruption and now facing slowing growth, we observe that the SA General Retail Index has declined from R400bn to R170bn (-57%) whereas the SA Gold Mining Index (excluding Sibanye) has increased from R140bn to R570bn (+300%).

Gold has numerous uses: wealth protection, financial exchange, jewellery, electronics, and space exploration to name but a few. Central Banks globally have been expanding their balance sheets by printing money since the Global Financial Crisis, with some temporary pauses. Covid-19 has now accelerated the pace thereof causing concern around currency debasement. Some investors are taking more comfort in the perceived safety and limited supply of gold over the printing presses of Central Banks. Investors' expectations for inflation as measured by the bond market using break-evens imply 1.5% which is still below the Federal Reserve’s own target of 2%. This is still almost 1 percent above the US 10-year government bond, implying that inflation is still being priced into asset prices and gold would be a natural hedge.

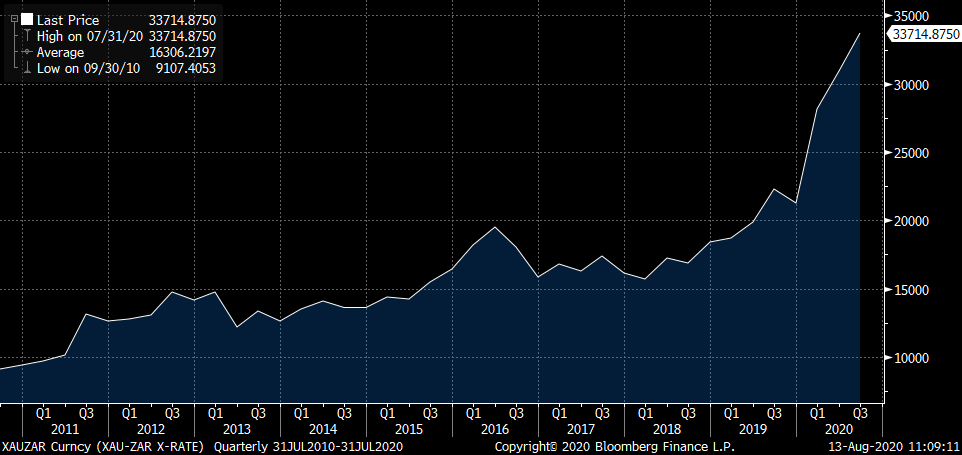

The gold price in rands reached an all-time high this year, peaking around R33,000/ounce and is currently hovering just below that level. We have seen record inflows into gold ETFs, alongside silver which has also been gaining traction lately, albeit a more industrial metal. Retail flows into gold ETFs have been positive for the 18 weeks to the end of July, the longest positive streak since 2006.

Gold and platinum miners, especially the South Africa deep level miners, have a large fixed cost base hence any upside or downside to their revenue has a meaningful impact on their profitability and associated cash flow. Given the medium-term bearish outlook for the rand and the supportive environment for gold, they should be net beneficiaries thereof. Gold companies' use of their current cash windfall will no doubt determine their fate.

We have held increased holdings in both gold and platinum producers as well as underlying commodity ETFs across all our mandates and have benefitted from identifying this opportunity early in the year.