Gold mining companies are enjoying the fattest profit margins they’ve seen in years. The gold price is near record highs, while many miners have kept a lid on costs. Put simply: they are selling each ounce for much more than it costs to dig it out of the ground. That gap is what drives operating margins and, ultimately, free cash flow. The key question for investors is whether these margins are a new normal, or another short-lived spike?

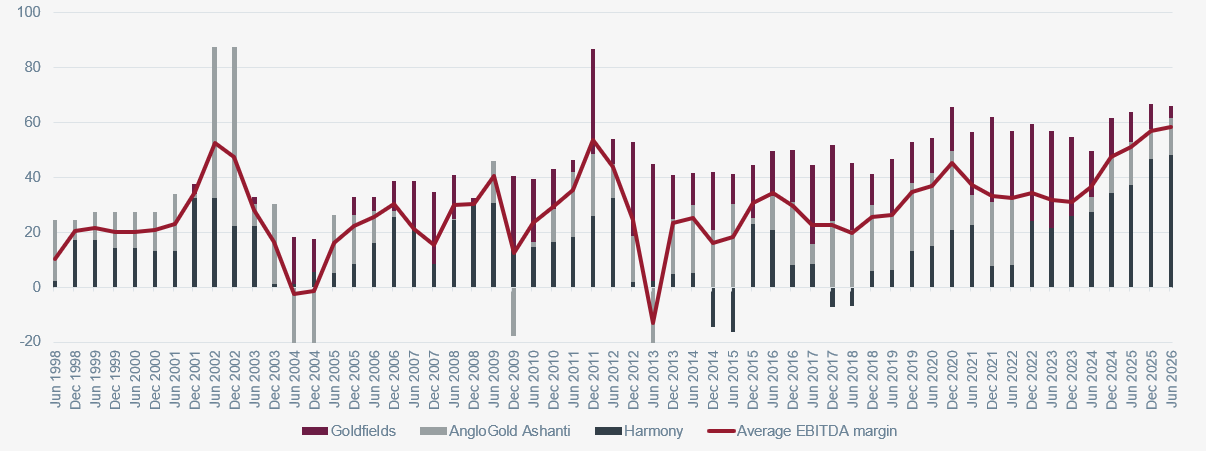

Gold miners have enjoyed three big “margin windows” in the modern era:

- Late 1970s to early 1980s: After the US left the gold standard, gold prices surged. Miners had a great couple of years. But energy prices also spiked and wages followed. As input costs rose and new supply came on, margins normalised.

- 2010–2012: Gold rallied strongly after the Global Financial Crisis. Miners posted excellent profits for two to three years. Then costs (diesel, steel, labour) and heavy project spending eroded returns, and share prices lagged when gold rolled over in 2013.

- 2020–2021: Gold jumped during the COVID shock. Costs initially stayed low, so margins ballooned. By 2022, inflation hit power, consumables and wages, squeezing that spread.

What feels different this time

There are a few reasons to think today’s strong margins could last longer than the last cycle. Many miners learned hard lessons after 2013. Instead of chasing every growth project, they’ve focused on returns, debt reduction and dividends. That makes windfall cash flows more likely to reach shareholders. Additionally, in past cycles, some producers locked in future sales at fixed prices and missed the upside. Today, hedge books are generally smaller. When the gold price is high, more of it flows straight into margins. Lastly, the industry now reports “all-in sustaining costs” (AISC), which include the ongoing capital needed to sustain production. This reduces the temptation to overspend without investors noticing.

What hasn’t changed (and still brings margins back to earth)

Energy and labour are decisive. Mining is energy- and people-intensive, while sustained increases in power tariffs, diesel, and wages compress margins quickly. In many countries, governments take a larger slice of royalties and taxes when prices are high. Another headwind to margins is related to geology – as mines age, ore grades can fall and waste-to-ore ratios often rise. Often the easiest and cheapest ore to mine is used first while lower margin ore body is mined only once prices rise further. Gold miners’ margins can likely stay elevated for a while, but not forever. Historically, the golden window of peak profitability tends to last one to three years. This cycle could run toward the longer end if the gold price holds up and cost inflation remains contained. The global macro backdrop currently supports bullion: markets are pricing US rate cuts into late-2025 alongside an easing dollar, central-bank buying remains strong (over 1,000 tonnes in 2024 which is roughly 30% of mine supply), and policy/geopolitical uncertainty is keeping gold’s “insurance” bid alive. The rally in gold miners has been a huge tailwind for the JSE in 2025 but ultimately it is likely to be a cyclical move similar to previous episodes.