You may have heard an odd term being thrown around – “a short squeeze”. This is a financial situation that can result in exponential rising prices in a share in a short period of time. This starts with investors being short a share. This is when you borrow shares to sell them in the market with the aim of buying them back later after a price drop in the stock. Your profit in this situation is the difference between the lower price you buy back the share and the original price you sold it at. Sometimes, many investors think the share price of a certain company will go down and they sell shares short. This creates a high ‘short interest’, meaning lots of investors are short the stock. This can eventually lead to a precarious situation where any upward move in the share price will start to ‘squeeze’ investors who have sold the stock short, resulting in a short squeeze.

So what can set off a short squeeze? Sometimes it’s as simple as the company not being as bad as people think and buyers of the stock start purchasing shares. This starts pushing the price up. If some of the short sellers begin to worry about their losses, they might decide to enter the market and buy back their short stock, thus creating more buying. The upward move in the share price can serve as verification for investors thinking the stock is a good story, leading to even more buying in the market., which then becomes an upward spiral or a short squeeze. Sometimes it can have nothing to do with the company stock itself, but rather that the lenders who gave their stock to the short sellers now want their stock back. These short sellers then need to buy back the stock in order to return it to the lenders. Shorting stock is not an easy strategy! However, it can be a valuable strategy to add performance and protect portfolios in bad markets.

Let’s take a look at an example with a well-known company. In early 2020, Tesla was the most shorted share on the US exchanges, with more than 18% of shares being short. From late 2019 through early 2020, Tesla shares were up over 400%. Investors looked at this electric vehicle manufacturing company and saw that its profits were mostly from government credits, not from selling cars. Given the recent rise, they did not think there was a reason for the share price to be so high and sold the shares short. This did not work out well for the short sellers and a short squeeze ensued.

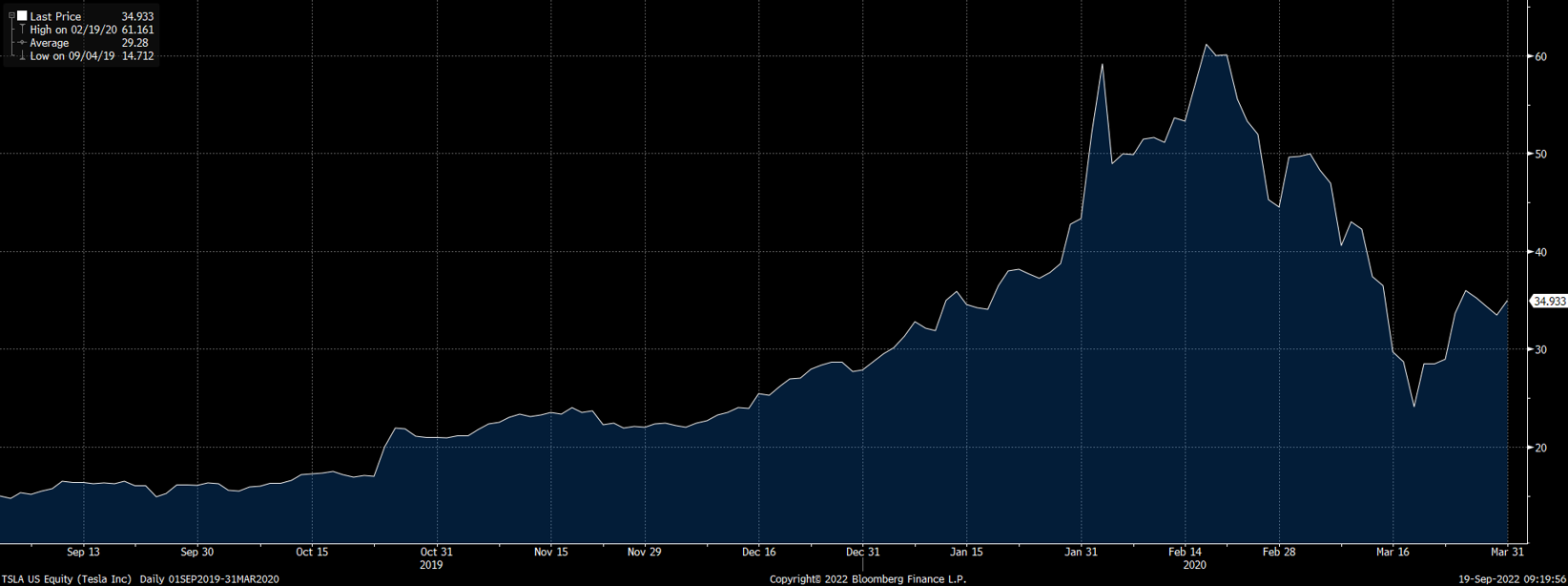

Below you can see the short squeeze in early 2020 and the subsequent fall following this.

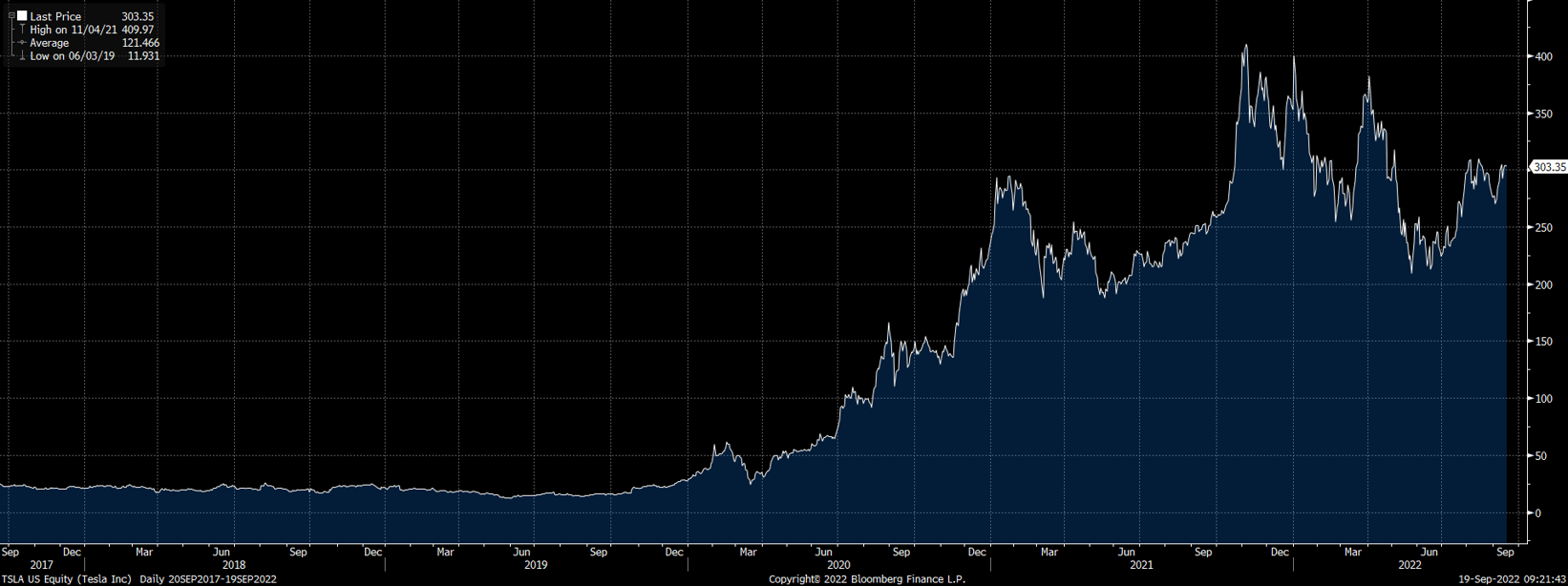

However, this was not the end of the pain trade for short sellers as you can see on the graph below. Assisted by the Covid mania that pushed many technology companies to meteoric highs, the share price continued to rise, being pushed up by new buyers and short sellers trying to buy their stock back. This episode of pain for short sellers destroyed interest in shorting the stock and currently Tesla’s short interest is 2.3%, vs the 18% at the beginning of 2020.

In the US markets there is information available to gauge how much of a stock is being sold short by investors. Unfortunately, in most markets outside of the US there is very little information of this sort available. However, this can still be an attractive strategy for a portfolio if the risks are managed carefully.

Some of the ways to manage risk include making sure the size of a short position is not too big. In this scenario, if the position moves against you, it is easier to manage. Another necessary step is to have a strong thesis for shorting a stock to begin with, as this will limit surprises that could interest buyers in the stock and set off a squeeze. Liquidity is also an important consideration, meaning the ease of trading the stock. If the stock trades in large volumes each day, then it follows that it will be easier to buy the stock back if needed. If the volume of stock trading per day is low, then it will be more difficult to buy the stock back and you may only land up buying the stock back at much higher prices.