2022 was a great year for gold. Many investors would say “but gold did nothing”, which would technically be correct with a -0.3% return. If you compare that to any other asset class in Dollars though, the performance was stellar and added a great diversifier to one’s portfolio.

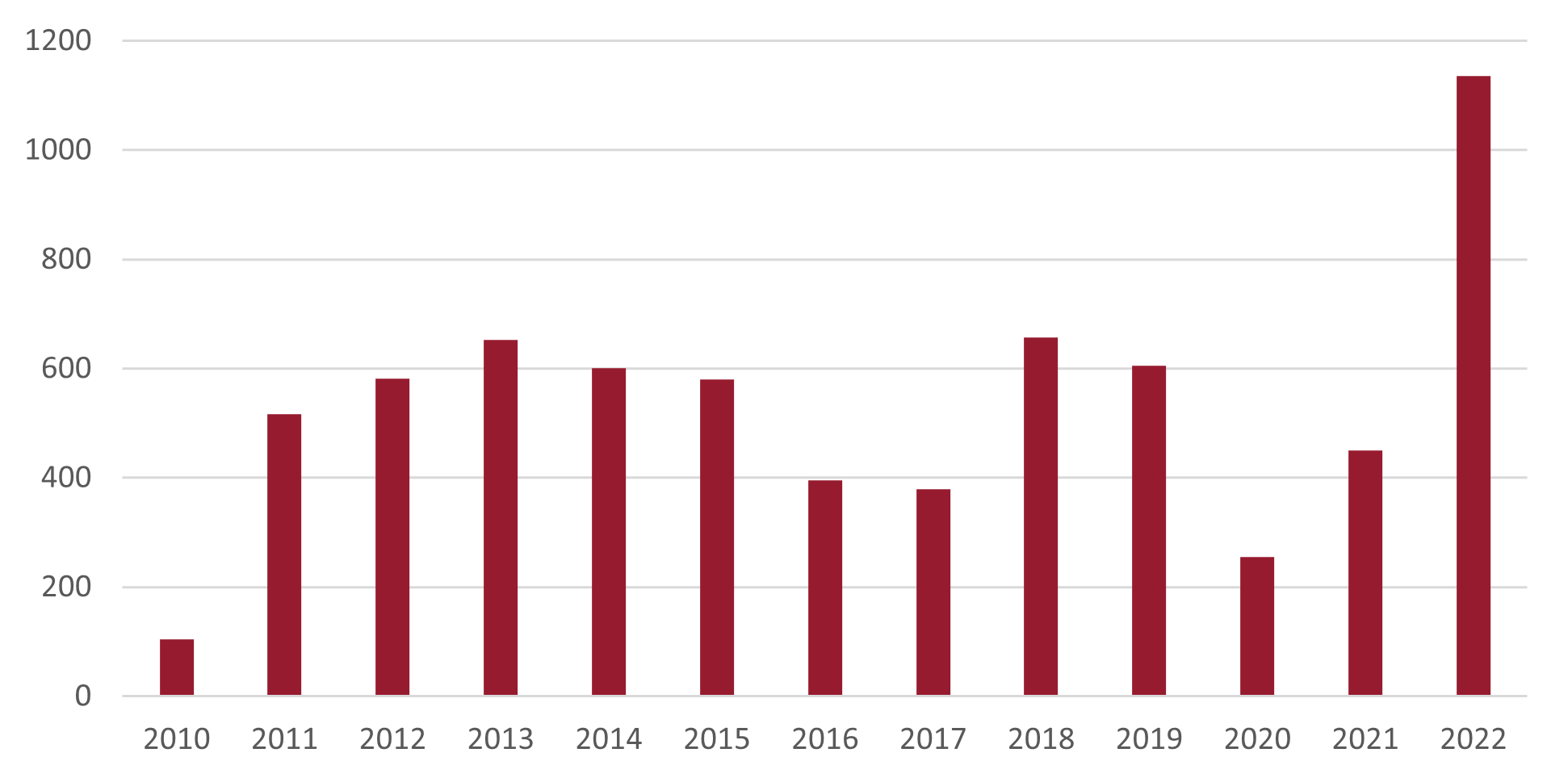

The biggest news in the gold market was the remarkable demand for gold from central banks. Gold demand from central banks was up 152% year on year to 1136 metric tonnes, which according to the World Gold Council was the highest demand in any one year going back to 1950. Demand in the first two quarters of the year was in line with prior years, but the last two quarters saw demand of 445 and 417 tonnes from central banks, surpassing some previous yearly demand numbers.

The shift in demand came mainly from the central banks of Turkey, China, Russia and India. The big change had two drivers.

One was the big increase in inflation worldwide. Central banks realised that holding their reserves in other currencies guaranteed value destruction as inflation was running materially hotter than the returns you could get from those holdings (negative real returns).

The other reason for increased demand was the unilateral confiscation of Russian reserves by Western countries after the invasion of Ukraine. The ease with which this was done made many countries with different political views to the West rethink their strategic asset allocations. The recycling of current account surpluses by developing countries into Western countries’ debt effectively came to a halt. This will have some long-term implications for Western nations as to how they continue funding their own current account deficits in future.

There has been a big push by Russia and China to shift settlement of trade away from the US Dollar. This may take many forms (Ruble or Yuan settlement, digital currency backed by gold settlement, outright gold settlement) and many of these ideas have been floated in the public domain. This will further reduce demand for Dollars over time and potentially increase demand for gold. The US Dollar accounts for over half of world trade and shifts away from Dollars will be a multi-decade trend. Calling for the death of the Dollar may therefore be premature, but over time gold may just be very alive.