"It is easy to lie to someone who wants to believe" — Barnabas in Peter Rabbit 2.

In the last 6 months we have seen many astounding moves in various asset classes. As good as the general equity markets have been, the returns were dwarfed at times by "no-profit" tech companies, meme stocks, Reddit or WallstreetBets "crowdstocks", and cryptocurrencies. Many of these investments went up as much as tenfold in a period of less than three months.

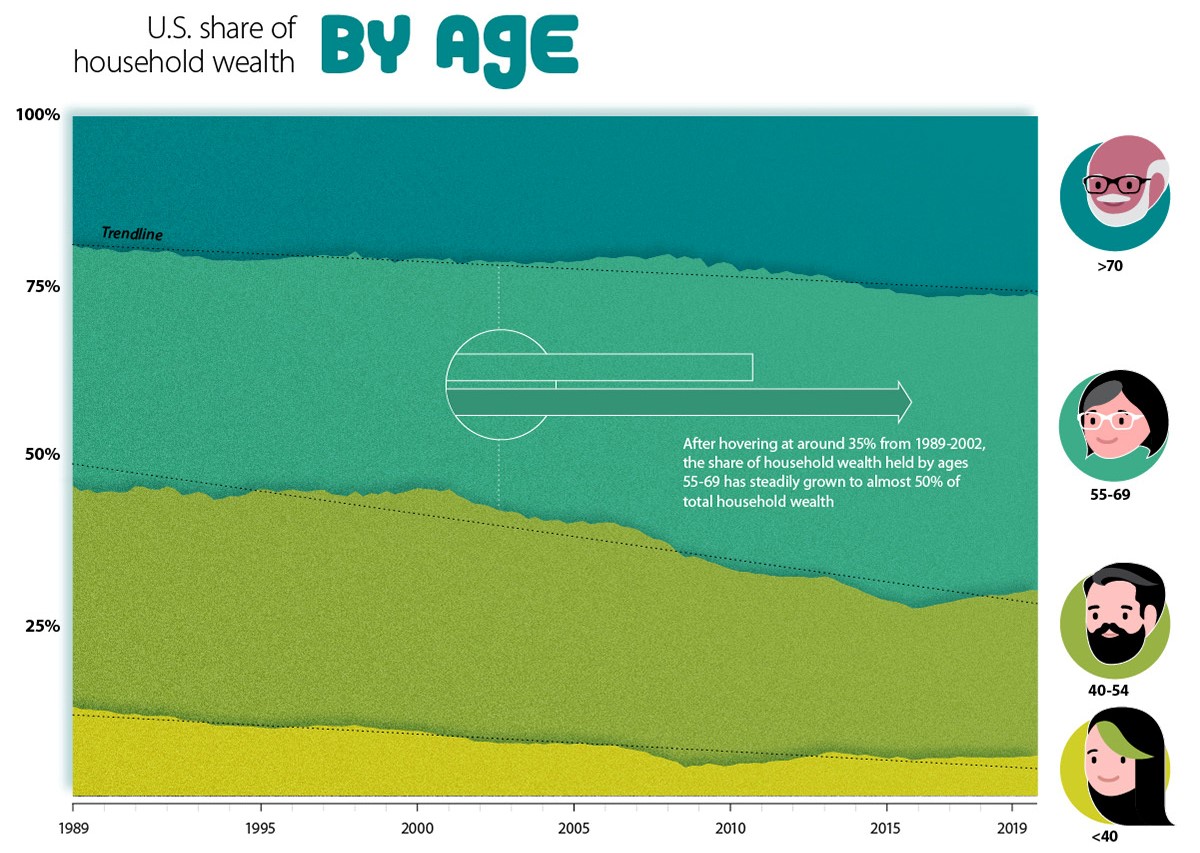

It seems a lot of the speculation in these markets are from retail investors, and more specifically millennials. With the under-40 cohort having less and less relative wealth, and traditional asset classes not offering opportunities to regain a share of wealth (think bond yields at decade-year lows), these investors are looking for opportunities to gain wealth quicker.

The US government gave them ammunition in the form of transfer payments, which they gladly put to work in these investments. It started out quite well and many believed, because they wanted to, that this was the way to riches. Unfortunately, this is just a lie, or what we in markets call a bubble. Most of these assets have reversed with many of them down over 50% from their peaks.

We all need to temper our expectations of returns. It is not normal to see returns like we have seen in these assets on a sustainable basis. We need to recognise that the real pathway to wealth is by letting compounding do its job over a meaningful period. This means resetting expectations, being happy beating inflation and maximising our savings rate. Yes, it is not as exciting, but it has been a proven recipe for the average investor over many years.

As a final thought I would like to offer a view on cryptocurrencies (one of many possible views). My view is that cryptocurrencies are currently in a bubble. There are many signs, with coins such as Dogecoin, which was created as a joke, hitting a market capitalisation of $90bn, and there being as many as 10 000 different coins to choose from. The market is moved by the tweets of a single person and many people are asking investment professionals their opinions on cryptocurrencies. Does it mean we have seen the top? I do not know. One should also not lose sight of the fact that even out of the 2000 internet bubble, whilst many companies went out of business, other great companies survived. Some of these are now amongst the biggest companies in the world. I think the technology behind crypto is here to stay and will give rise to many great companies in the years to come. There will however not be place for 10 000 cryptocurrencies, and the vast majority of these will be worthless.