The South African (SA) new vehicle market has been under pressure over the past few years, as consumers face increasing constraints on their disposable incomes. Passenger car sales were negative in three of the five years before the onset of the COVID-19 pandemic and have struggled to consistently return to pre-pandemic average levels (Chart 1 below).

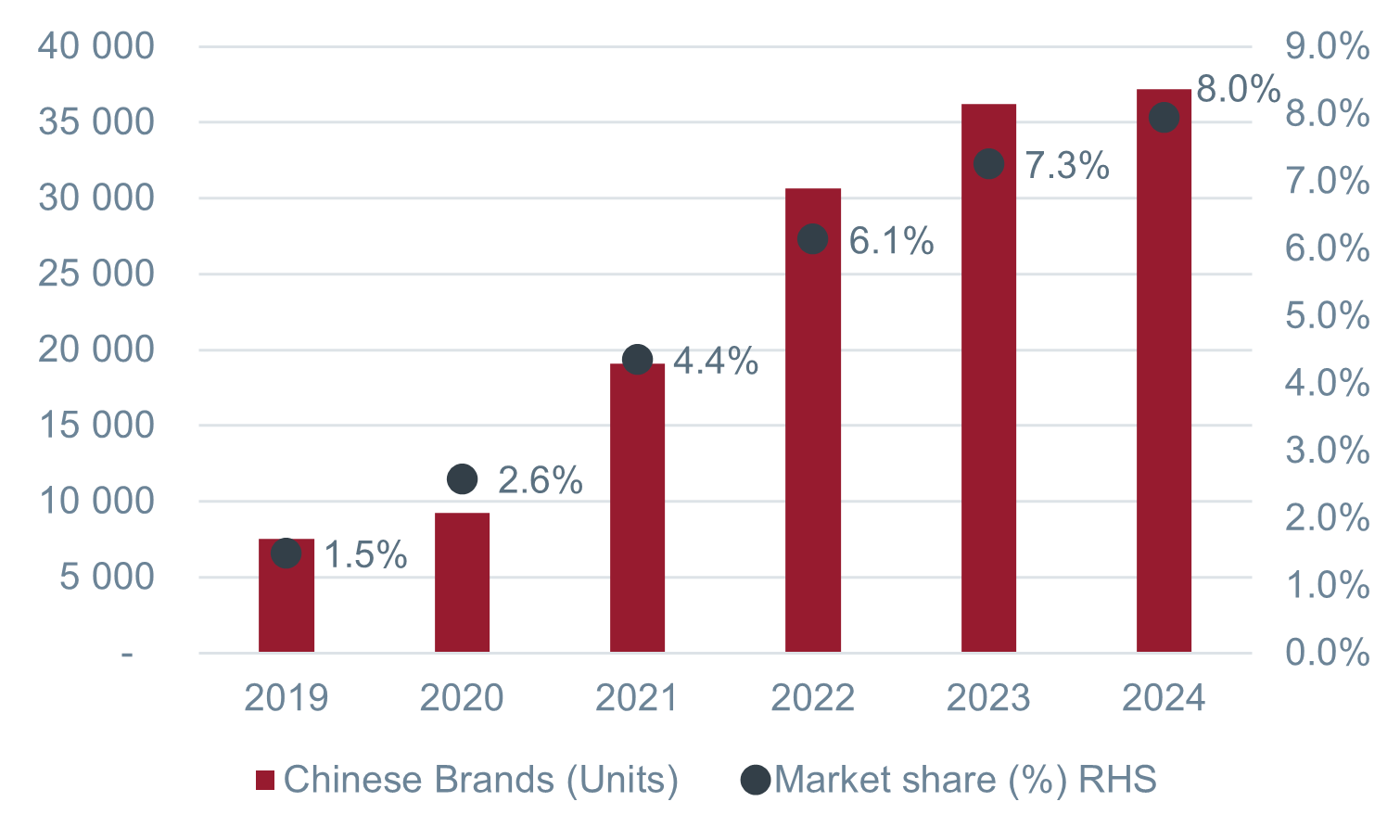

Despite this overall pressure, new entrants from Asia, particularly China, have been able to grow in this market. Traditionally dominated by well-established global manufacturers, the market has seen a surge in the popularity of these Chinese brands. Chart 2 below demonstrates how Chinese automakers (OEMs) have increased their market share more than fourfold since 2019. The popularity of these Chinese brands is driven by their affordability, advanced features, and value for money; factors that are increasingly important to consumers facing economic pressures.

Historically, the market was dominated by European, American, and Japanese manufacturers, who offered a wide range of vehicles across various price points. However, the tide has turned. Household names such as Volkswagen and Toyota, which together made up almost 60% of the SA passenger and light commercial market in 2017, now account for around 40% of the market year-to-date in 2024.

As these traditionally dominant brands have become more expensive, a gap has emerged that Chinese OEMs have been quick to fill. This shift has been particularly pronounced in the entry-level and mid-range segments, where cost-conscious consumers are seeking affordable alternatives without compromising on quality and features. Traditional brands have also shifted focus to value over volume models, as seen with Ford discontinuing the Fiesta in favour of the higher-value and extremely popular Ranger.

Chinese OEMs have also benefited from having supply chains that were less disrupted during the global semiconductor shortage, allowing them to maintain a steady supply of vehicles when other brands faced constraints.

Chinese OEMs are in SA for the long term. Chery, for instance, has established a significant dealer network across SA, with more than 80 standalone dealers. Additionally, new brands such as BYD, Omoda, and Jaecoo have entered the market, each targeting different segments from electric vehicles to premium SUVs. This diversification should allow Chinese OEMs to cater to a wide range of consumer preferences, further driving their growth.

The future looks promising for Chinese automotive brands in South Africa. As they continue to innovate and introduce new models, their market share is likely to continue growing. The implication for traditional brands is clear: they must innovate to remain relevant. In a few years, it’s very likely that brands such as Chery, BYD, and Haval will become the new household names.