After several years of challenging conditions, long/short equity strategies are entering a more favourable environment. Declining inter-stock correlations, rising dispersion, and a normalisation of interest rates are restoring the importance of security selection and setting the stage for improved alpha generation.

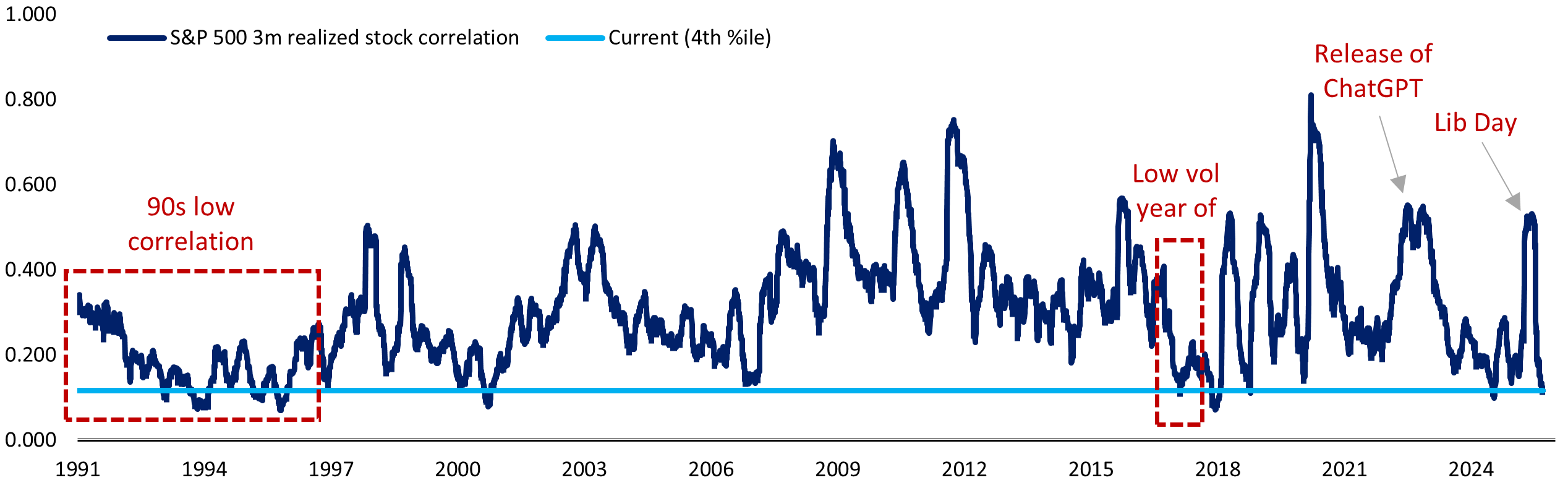

In the years following the 2008 global financial crisis, equity markets were largely driven by macroeconomic forces. Between 2008 and 2012, inter-stock correlations reached abnormally high levels as risk-on/risk-off sentiment dictated market behaviour. In this environment, company fundamentals mattered little; securities moved together based on global liquidity and policy expectations.

For managers whose success depends on identifying company-level mispricing, such homogeneity proved difficult. Historical data shows a clear inverse relationship between inter-stock correlation and global hedge fund alpha: as correlations rise, alpha tends to contract. Since 2012, however, global correlations have steadily declined. Markets are once again discriminating between strong and weak companies based on fundamentals rather than macro momentum. This shift has already coincided with a recovery in hedge fund alpha, and we believe it lays the foundation for a more constructive environment ahead.

Dispersion – the spread between high and low valuation multiples or stock returns – is another critical determinant of long/short performance. When dispersion is low, even strong stock selection adds little value. When it rises, skilled managers can better capitalise on relative value differences.

Historically, dispersion has shown a positive correlation with interest rates. Low rates compress valuations across sectors, reducing differentiation. As rates rise toward more normalised levels, the cost of capital becomes more relevant, magnifying performance gaps between companies with solid balance sheets and those burdened by excessive leverage or narrow margins.

The prevailing low-rate environment has also diminished the return potential on the short side of portfolios. The “short rebate” – the interest earned on the cash proceeds from short sales, net of borrowing and transaction costs – has been negligible, and in some cases negative, for much of the post-crisis era. In a more normalised rate environment, this rebate can again become a meaningful contributor to returns.

The equity market backdrop is evolving in ways that are structurally favourable for long/short investing. Lower correlations, wider dispersion, and the gradual reintroduction of interest rate differentiation are restoring conditions where active management and fundamental research are more effectively rewarded.

For 36ONE’s hedge funds, these developments signal an improved opportunity set. With greater variability in corporate outcomes and a renewed emphasis on valuation discipline, markets are once again offering the kind of inefficiencies that long/short strategies are designed to capture. While macro volatility and cyclical shifts will persist, we believe the balance of factors points toward a more conducive environment for consistent alpha generation – one that aligns well with 36ONE’s fundamental, research-driven investment approach.