Within the US retail sector, there has been a significant disparity in valuation. A select few retailers have been successful at navigating the challenging environment, and trade at higher valuations, while others have fallen by the wayside which is reflected in their share price.

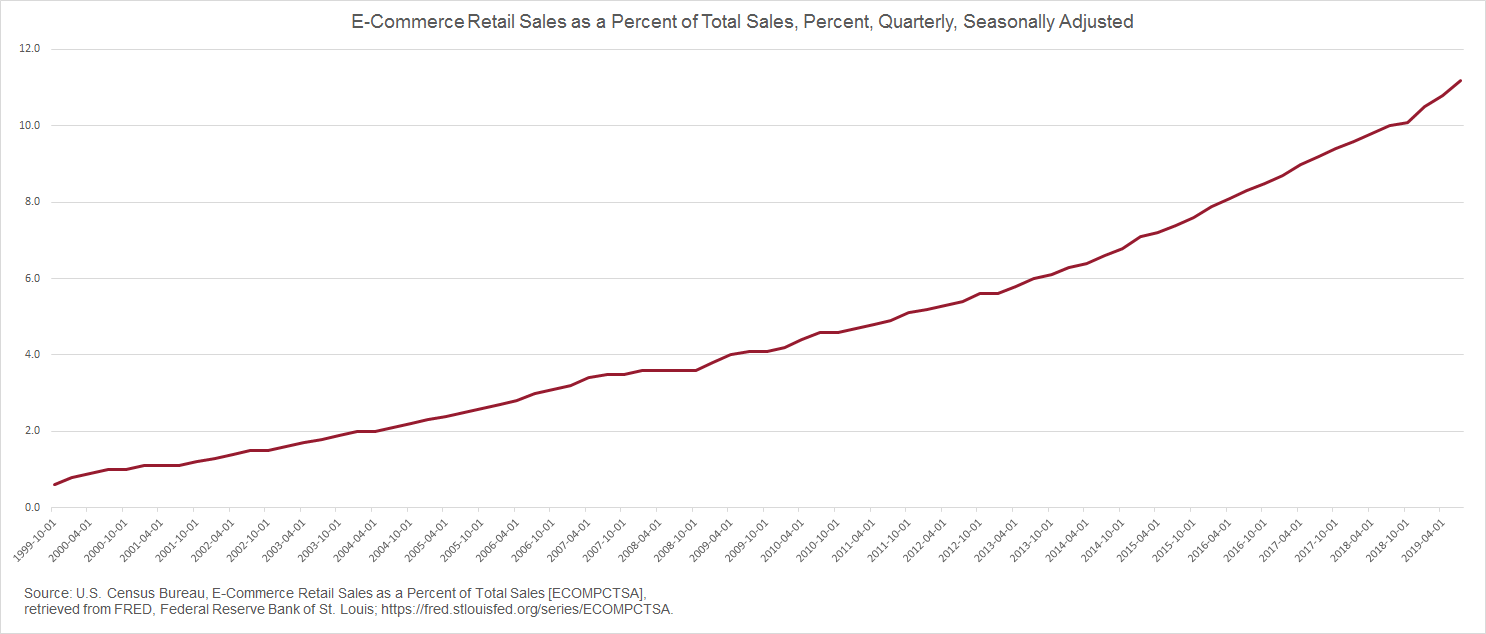

The foremost challenge to brick-and-mortar retailers is the “Amazon threat”, as Amazon and other e-commerce retailers take a larger share of US retail sales:

Invariably, when Amazon announces its entry into a new category the share prices of the incumbent Brick & Mortar retailer takes a significant hit.

However, there have been a few retailers who have managed to thrive in this challenging environment. Wal-Mart, Target, Costco as well as the off-price retailers like TJ Maxx and Ross Stores, have been successful at growing sales, and even showing e-commerce growth rates in excess of Amazon’s. While each of these companies utilised a different strategy, both Wal-Mart and Target recognised the need to utilise their brick-and-mortar footprint to be successful in an online world.

Many retailers were unable to balance the need to utilise e-commerce channels while still running physical stores.

Target is a case study in how to succeed in brick-and-mortar in this environment. Two years ago, they embarked on a strategy to leverage their store footprint – they have a store within 10 miles of 80-90% of Americans – by using them as distribution centres. They then moved to digital sales focusing on same day services via drive up, pick up, and shipt (shoppers pick up and deliver your orders).

Counter intuitively, these same day digital sales are substantially cheaper to fulfil than regular e-commerce sales. As the CEO commented: “Even though we continue to grow digital sales at a very rapid pace, we are seeing less pressure from fulfillment costs, given that we're leveraging our stores, teams and assets to fulfill the vast majority of our digital volume.” “As we shift our fulfillment to our stores, we see our cost go down by upwards of 40%. When it moves to one of our same-day options, pick up in-store, drive up or shipt, we see a 90% reduction in that cost. So obviously as we're seeing the acceleration of our same-day convenient options, more guests opting to order online and pick up or use drive up or shipt, we're seeing the benefits of that flowing through our P&L.”

Amazon may be a threat to many industries, but to succeed companies need to play to their strengths. They need to recognise the potential of their assets and utilise them appropriately in this ever-changing digital world.