In early July, Dubai based DP World announced an offer to acquire all the outstanding shares in Imperial Logistics (IPL), at a c.40% premium to its last closing price. This also comes after a recent cautionary from Distell (DGH) noted the intention by Heineken to acquire a majority stake in the company. The market expects a healthy premium from this transaction if one were to go by the 17% gain in the share price post the announcement.

Takeout transactions are not new in the small to mid-cap space on the JSE – we’ve seen other transactions for the acquisitions of Clover, Afrox, and Pioneer Foods, to name a few. These companies were acquired and delisted at juicy premiums.

Despite a rebound from March 2020 lows, many small to mid-cap JSE listed stocks still trade at discounts to their historical valuations. Investors are reminded when a takeout is announced that they may have overlooked these stocks.

Off the back of the associated euphoria, it is sometimes tempting as an investor to screen purely for these heavily discounted stocks in the hunt for the next takeout target. Investors should apply a comprehensive investment process in identifying stocks which they deem undervalued and ripe for takeout.

The investment considerations for a takeout acquirer may not necessarily be the same as a market investor, which is important to understand. For example, a market investor may consider liquidity of the stock before making an investment decision.

Liquidity measures how easily a stock can be traded. The more liquid the stock, the easier it is to enter and exit positions and vice versa for an illiquid stock. Therefore, a liquidity discount may be appropriate in determining a desired fair value for a market investor.

Another divergence in considerations is that a listed stock trades based on a minority valuation. To put that differently, a market investor is not necessarily looking to gain control of the company. Control means the acquirer has full access to the target’s cash flows, can realise synergies, can set strategy, and could be involved in day-to-day operations. Accordingly, an acquirer would consider paying a control premium.

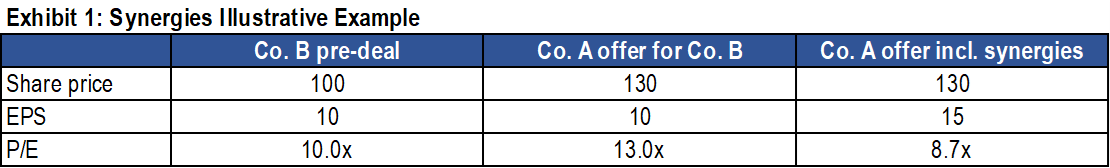

Realising synergies has the potential to make a transaction far more accretive for the acquirer than the initial offer may suggest. Synergies usually arise on cost savings, operational efficiencies, procurement benefits, improved capital structure etc. Consider this scenario:

Company A makes an offer to purchase all the issued share capital of Company B at R130 per share, which is a 30% premium to the last closing price of R100 per share. Company B’s estimated earnings per share (EPS) is presently R10. Company A has effectively paid a Price Earnings (P/E) ratio of 13x which compares to 10x that Company B was trading on prior to the announcement of the transaction. Assume that Company A believes it can extract synergy benefits of R5 per share. A simple P/E analysis demonstrates how much Company A really is paying for the transaction:

What looked like a premium valuation in the hands of existing shareholders is a 13% discount for the acquirer. This looks like a win for both existing and prospective shareholders. This will however depend on the entry point of the existing shareholders.

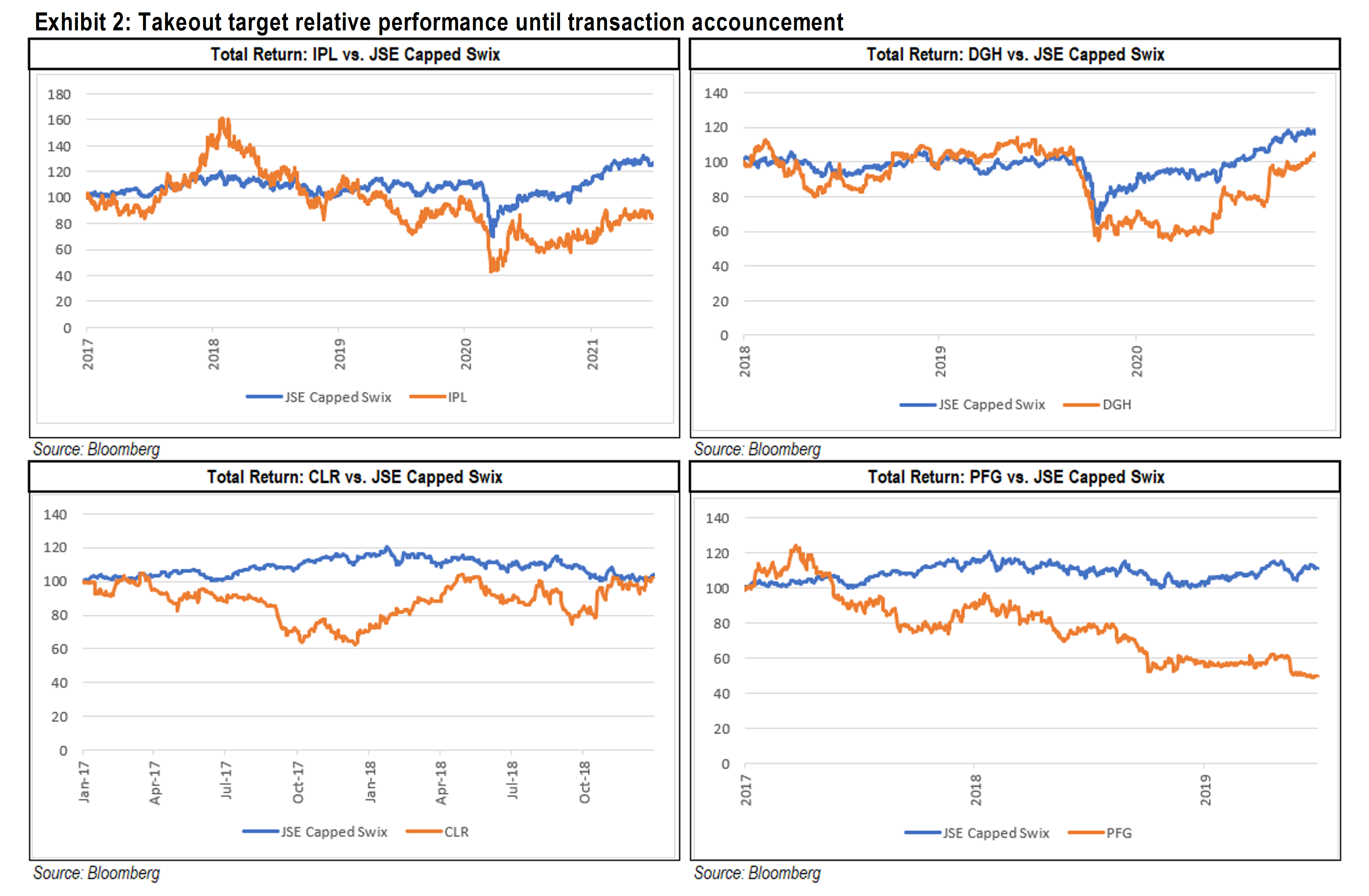

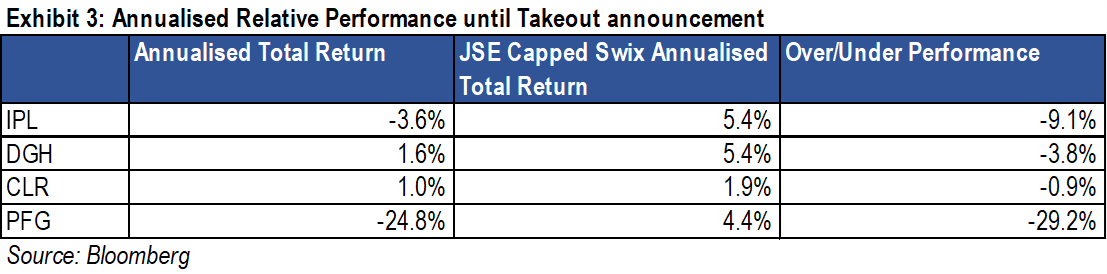

A market investor may need to sit through long periods of underperformance before a takeout offer materialises (if ever). We look at the performance of Imperial Logistics (IPL), Distell (DGH), Clover (CLR) and Pioneer (PFG) vs. the JSE Capped Swix leading up to a month before the announcement of a takeout. Market investors’ patience is tested during the period.

The focus in this article so far has been on the different considerations of acquirers and market investors. It is fair to highlight, however, that there are also overlaps in what the two groups may consider. These include (but not limited to) the strength of business model, market position, growth prospects and capital allocation track record. Incorporating these considerations into an investment process may put market investors in a better position to identify undervalued stocks at the right entry point and avoid value traps.