During January 2023 global electric vehicle (EV) market leader Tesla announced drastic price cuts to its Model 3 and Model Y across China, USA, and Europe in the range of 1-20%. Ford followed by announcing price cuts of 6% on average on its Mustang Mach-E in the USA.

Price cuts to list prices are not usual in the automotive industry because, amongst other things, it upsets customers that have recently paid higher prices. What is further perturbing about these price reductions is that automakers have continually emphasised that EV demand far exceeds supply, as can be seen in recent company commentary:

“We currently are seeing orders at almost twice the rate of production…”

“We are producing more EVs to reduce customer wait times, offering competitive pricing and working to create an ownership experience that is second to none…”

It is well documented that inflation has accelerated over the past few months and input costs have thus risen sharply. Despite inflationary pressures easing more recently, costs remain at elevated levels. Price cuts thus are a risk to industry profitability.

Economics 101 says that when demand is greater than supply, prices should increase, not go down. In 2022, global battery electric vehicle (BEV) sales rose 60% from 2021, with China (+69%) and Europe (+31%) leading global BEV penetration to c.13%, whereas traditional internal combustion (ICE) sales declined by 5%. Comments and data point to a robust EV demand environment, so why cut prices?

Accessing the mass market

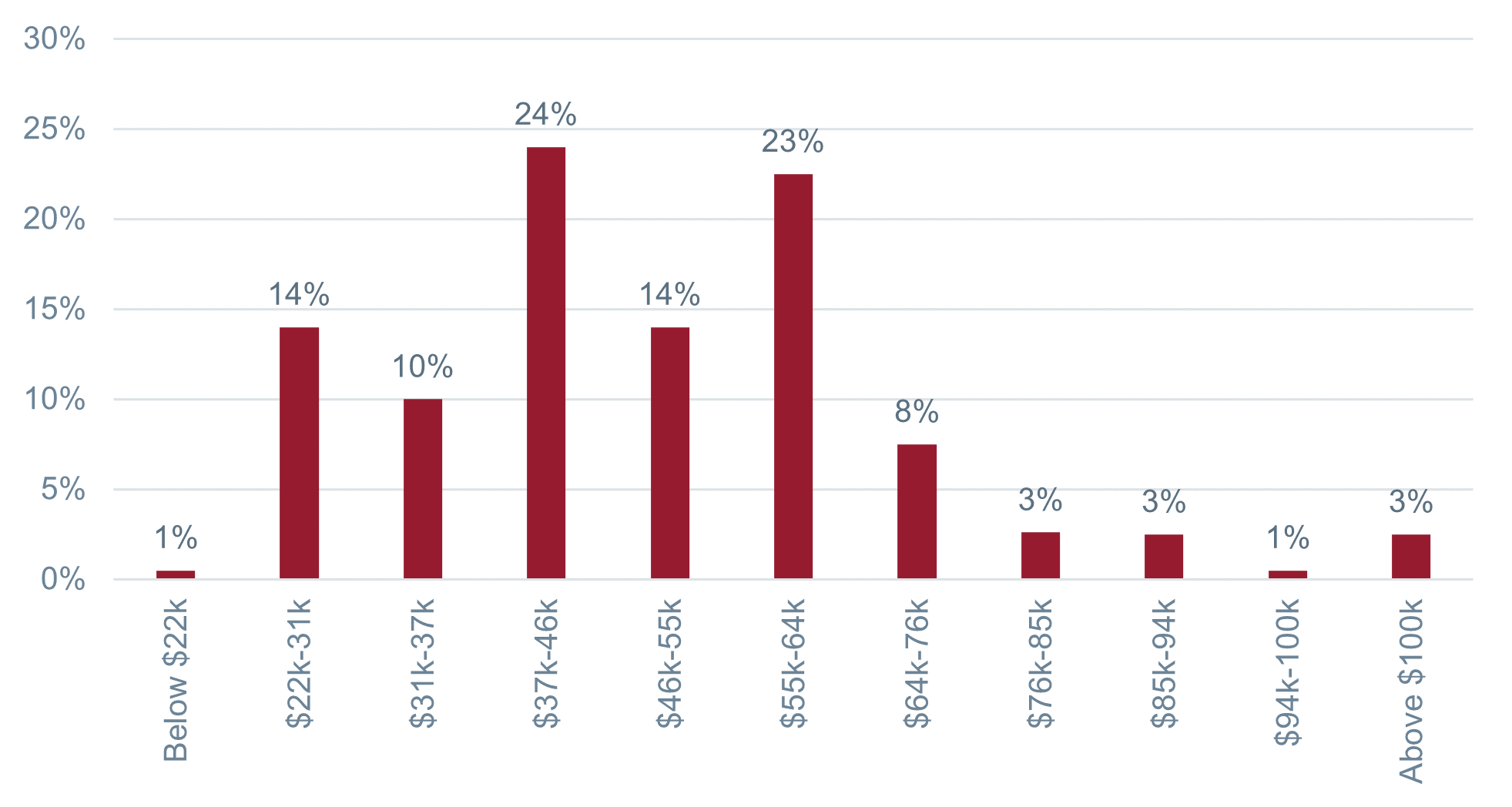

One possible answer is to make EV’s more affordable and accessible to a larger consumer base. There is only limited volume that is sold at higher price points (Chart 1 below), so unit volume growth could become restricted for higher priced offerings.

Volume growth leads to improved capacity utilisation and thus operating efficiencies. Indeed, ramping up EV capacity requires significant investment. Bank of America estimates Tesla will need to invest $40-70bn+ to get to its 2030 capacity targets. Such a large investment requires mass market appeal.

Competitors racing to ramp up sales

There are 26 new EV models that are set to be launched in 2023 and 125 over 2022-25 globally. Competition is clearly increasing, and incumbents need to react appropriately to defend market share. The risk to the industry is a price war which could essentially become a race to the bottom.

In a price war scenario, legacy OEM’s may allocate less capital to their EV businesses as returns become less attractive due to lower margins. Furthermore, the survival of startup EV companies is put at risk as they do not have a legacy ICE business to support free cash flow in the event of thin margins.

Price wars can lead to disastrous consequences for individual companies. What was seen in the 2000’s was the bankruptcy of General Motors in 2009 after a prolonged industry price war combined with a drop in vehicle sales due to the global financial crisis.

We have been here before

That said, as suggested earlier, EV deflation can lead to increased penetration, albeit at the risk of industry margins. Morgan Stanley points out that in 1907, the average price of a vehicle at the time was $2,834 with 43k vehicles produced in the USA and 255 vehicle manufacturers.

The introduction of the standard Model T by Henry Ford in 1908 at $825 per unit opened the mass market and effectively started a race to the bottom in the industry. In 1925 the standard Model T retailed at $260 and by 1929 there were only 44 remaining automakers with the top 3 making up 80% of the USA market. Unit sales accelerated during this period which could be seen as a blueprint for the industry today.

No immunity to macro headwinds

Higher interest rates globally have increased the cost of financing a vehicle which is a headwind to consumer affordability and could ultimately threaten EV demand. Accordingly, price cuts could ensure continued EV volume growth in 2023. Automakers will need innovative manufacturing processes to remain competitive, which should be good for the economy as it leads to efficient allocation of resources. It is yet to be seen how this all plays out, but the journey to electrification should be an exciting one to watch.