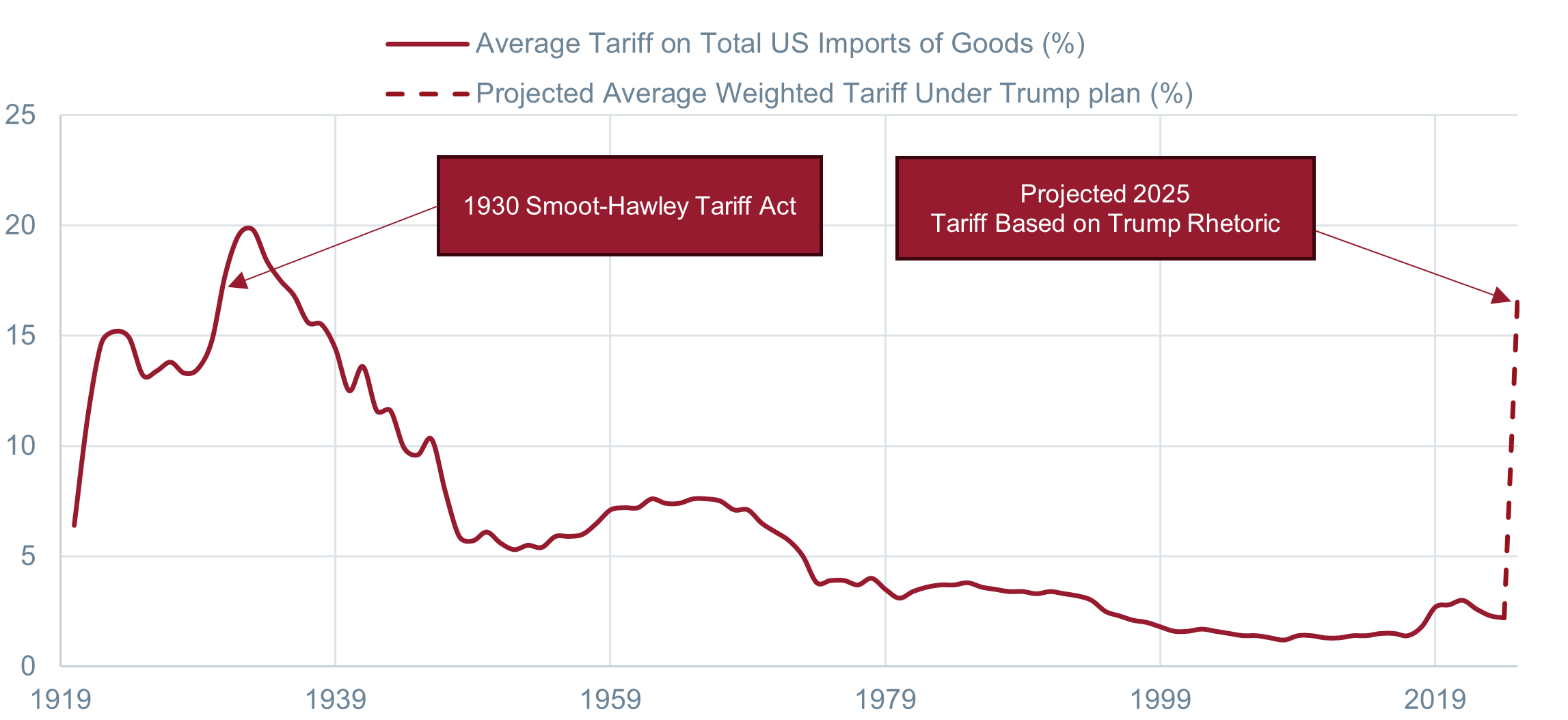

Shortly after securing his election victory, Donald Trump reignited his rhetoric on tariffs, initially threatening an across-the-board tariff of 10%, later escalating this to figures as high as 20% and 50% for specific countries, including China. At one point, he floated the possibility of a 60% tariff on Chinese imports, signalling his willingness to take an even harder stance against China. These proposals, if implemented, would elevate the U.S. weighted average tariff to an estimated 17% from 2.3% in 2023, representing the highest levels since the Smoot-Hawley Tariff Act of 1930, which averaged 20% and is widely regarded as a catalyst for the Great Depression’s economic fallout.

Corporate Fear and Pre-emptive Moves

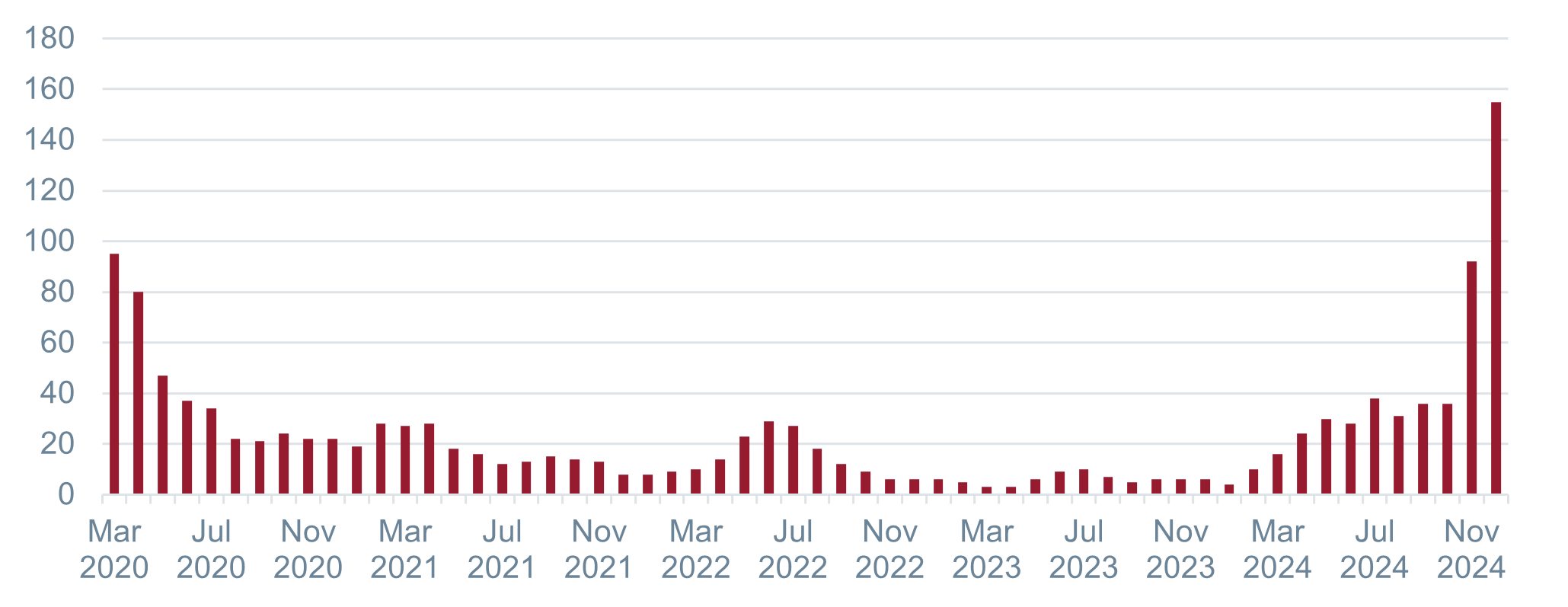

Unsurprisingly, Trump’s pronouncements have instilled a sense of urgency and fear among businesses. This fear is evident in the surge of references to tariffs during earnings calls, particularly in industrial sectors reliant on global supply chains. For instance, Bloomberg’s analysis noted a dramatic rise in mentions of ‘tariff’ by executives of S&P 500 companies, the highest level since late 2019. Industrial firms are at the forefront of these concerns, reflecting their vulnerability to increased costs. The two graphs below, illustrating the spike in tariff-related mentions and front-loading orders, underscore this widespread anxiety. Companies have responded by pre-emptively stockpiling inventories, expediting shipments, and diversifying suppliers – actions that have driven up shipping costs and created supply chain bottlenecks.

Historical Context: The Shadow of Smoot-Hawley

The proposed tariffs echo the infamous Smoot-Hawley Tariff Act of 1930, which raised U.S. import duties by approximately 20% and spurred retaliatory tariffs from 25 nations. Global trade plummeted by 66% between 1929 and 1934, deepening the Great Depression. As historian Doug Irwin observes, Smoot-Hawley is remembered as “among the most catastrophic acts in congressional history”.

A similar policy under Trump would disrupt trade relationships further, with imports and exports expected to shrink substantially. Bloomberg Economics projects that China’s share of U.S. imports could fall to 2% from 14% if such measures materialise.

Cabinet Dynamics: A Measured Approach?

Despite Trump’s aggressive rhetoric, analysts believe a more measured approach is likely. The officials rumoured to be in the running for top economic jobs – Scott Bessent, Kevin Warsh, and others – have expressed scepticism about strictly implementing Trump’s more extreme tariff proposals. These potential candidates might bring a balancing perspective to the administration, counteracting the influence of tariff hardliners such as former U.S. Trade Representative Robert Lighthizer. Additionally, practical constraints, such as the procedural requirements for tariff implementation and the revenue needs to finance proposed tax cuts, provide natural boundaries.

The Three Pillars of Trump’s Tariff Strategy

The likely tariff framework under Trump would rest on three main pillars:

- Strategic Targeting: As seen during Trump’s first term, tariffs would likely focus on intermediate and capital goods and less on consumer goods to minimise inflationary impacts while avoiding consumer backlash. Targeting intermediate goods reduces production costs for domestic industries, while excluding consumer goods shields households from direct price increases, mitigating public dissent.

- Revenue Generation: Tariffs are expected to contribute significantly to offsetting the cost of extending the 2017 Tax Cuts and Jobs Act, estimated at $500 billion by 2026. If a universal tariff were to fund half of this amount, then the average tariff rate would need to increase to approximately 8% from around 3% currently – short of Trump’s promised 20%. This highlights the fiscal pressure to find sustainable revenue streams, making tariffs a politically viable yet economically impactful option.

- Negotiation Leverage: If a similar logic to Trump's first term applied, the timing of tariffs would be coordinated with tax policies, constrained by procedural requirements, and designed to maximise negotiating leverage. This approach could lead to trade actions being implemented in three waves: 3Q25, 1Q26, and 3Q26. Gradual rollouts provide opportunities for tactical adjustments based on trade partner responses, allowing the administration to strengthen its bargaining position while mitigating immediate backlash. Additionally, phased implementation ensures time for domestic industries to adapt to shifting trade dynamics, further solidifying the strategy’s impact.

Conclusion: Navigating Uncertainty

While Trump’s tariff threats have sparked considerable alarm, the reality may fall short of his campaign trail hyperbole. A combination of internal cabinet dynamics, economic constraints, and historical precedents suggest a more restrained execution. Nonetheless, even a moderate implementation of these policies could significantly reshape global trade, with ripple effects across inflation, supply chains, and economic growth. The next chapter of U.S. trade policy under Trump promises to be as contentious as it is consequential.