If you own any offshore unit trusts, global balanced funds, or U.S.-heavy equity exposure (directly or via local feeders), the U.S. consumer matters more than most headlines suggest. Household spending is the engine of the U.S. economy, and when it holds up, it tends to support corporate earnings – from technology platforms and payment networks to travel, leisure, and everyday retail.

If you had looked at the headlines a year ago, you probably would have bet against the US economy. We were facing a "perfect storm": new tariffs making goods more expensive, a cooling job market, and prices that just wouldn’t stop climbing.

Yet here we are at the start of 2026, and the American consumer has done what they do best: survive and spend. One of the most surprising stories of 2025 was that U.S. spending remained resilient despite a noisier backdrop: trade/tariff uncertainty and a labour market that clearly cooled through the year. Yet, for investors, the key lesson was not simply that “the consumer held up.” It was how consumption held up – and who did the holding up.

That distinction matters, because the most investable consumer thesis for 2026 is not “everyone is fine.” It is that the U.S. economy can continue to grow even when the consumer experience is bifurcated, provided the top half (or top third) of households remains employed, confident, and liquid.

The story behind spending in 2025

-

Spending didn’t collapse, despite a softening labour market:

- By the end of 2025, the U.S. job market was no longer “red hot.” Hiring slowed meaningfully: payroll employment rose by 584,000 in 2025 (about 49,000 per month on average), and the unemployment rate ended December at 4.4%.

- Under the surface, more people were also working part-time because they could not find full-time work, up 980,000 over the year.

-

Even with pressure in parts of the market, the consumer was still spending – often more value-focused and promotion-driven:

- U.S. retail and food-services sales were up 3.5% y-o-y in October 2025 (in nominal terms).

- Online holiday spending hit a record $257.8bn, up 6.8% y-o-y, with Buy Now Pay Later usage around $20bn.

-

The power of the K-shaped economy:

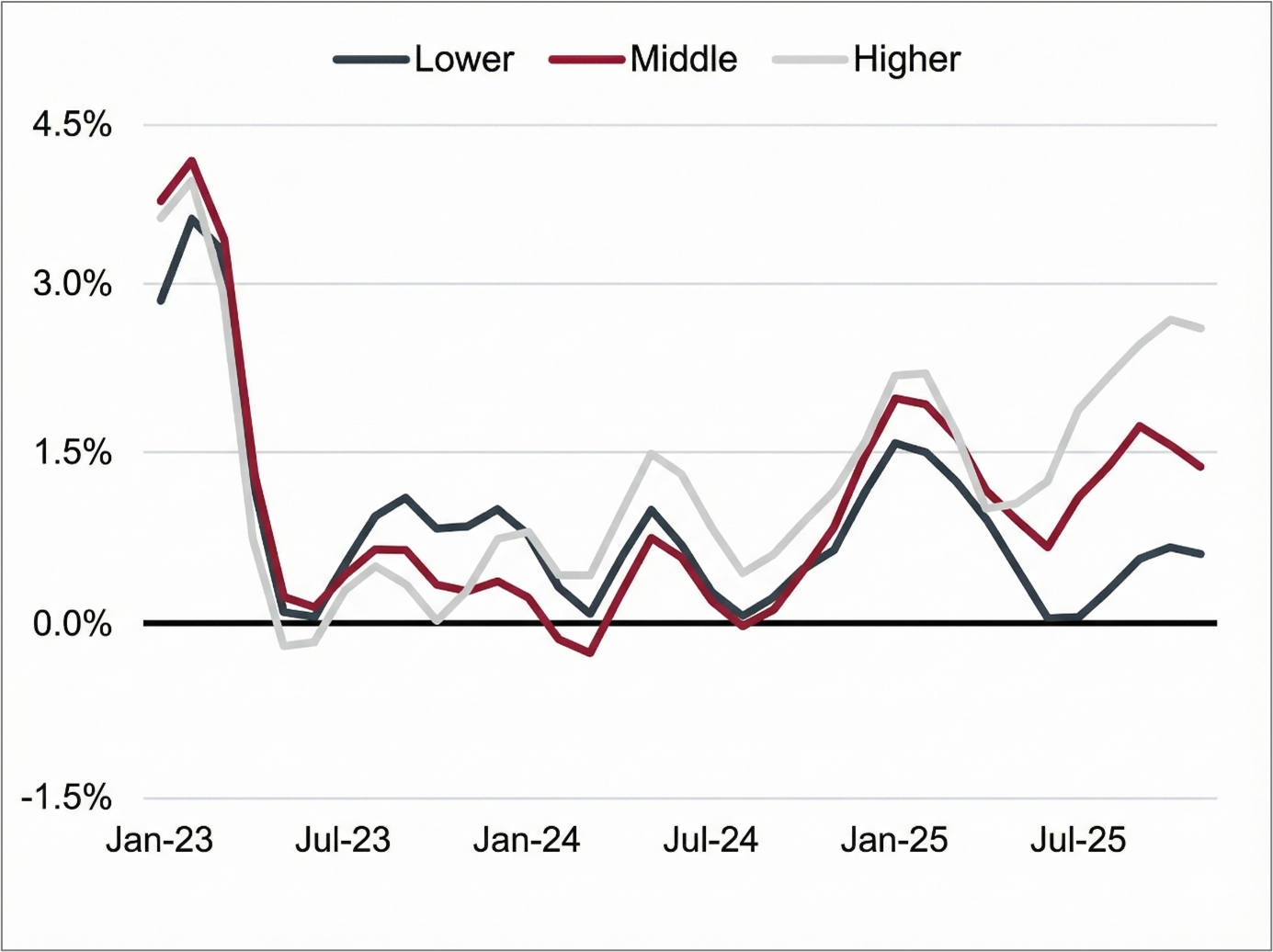

- In late 2025, lower-income households saw only 0.6% y-o-y growth in card spending, versus 2.6% for higher-income households (per Bank of America).

- This divergence widened through 2025, linked to differences in after-tax wage growth and job-market outcomes across income bands.

- Transaction data points to a “K-shaped” pattern where higher-income households carried a lot of the spending, while lower-income households struggled under persistent cost pressure and weaker hiring momentum.

- This matters because higher-income households account for a disproportionately large share of total discretionary spending. So even if many people feel stretched, the “top end” can keep overall consumption – and earnings – more resilient than expected.

-

Three stabilisers helped the U.S. consumer in 2025:

-

Inflation eased enough to help real spending power.

U.S. inflation (PCE) was around 2.8% y-o-y in September 2025, which reduced the squeeze versus earlier periods. -

Asset prices matter – especially for the spend-heavy cohort.

The top income groups benefit more from rising markets: in 2025, the top 20% by income held about 87% of directly held equities. -

Household debt costs were manageable at the aggregate level.

The household debt service ratio was about 11.25% in Q2 2025 – elevated versus the ultra-low period, but not at crisis levels.

-

Inflation eased enough to help real spending power.

Total credit and debit card spending per household, according to Bank of America card data, by household income terciles (3-month moving average, YoY%, SA)

2026: The Additional Tax Refund Tailwind

Due to recent tax law changes, the US is looking at a record-breaking tax refund season. Analysts estimate that over $400bn will be pumped back into household bank accounts over the next few months. The average refund is expected to be 15-20% higher than last year, concentrated in middle income consumers. American consumers tend to view this as “new money” rather than a return of their cash. Historically, large refunds lead to a surge in spending on electronics, appliances, and car repairs in Q1 and Q2. Many are also likely to use this to pay off high-interest credit cards, "resetting" their ability to spend. This tailwind and any Trump-related stimulus such as a “tariff refund” would further support consumption.

Key risks

“Don’t bet against the U.S. consumer” has worked because the main constraints haven’t fully bitten yet. The red flags to monitor are:

- A meaningful decline in asset prices reversing the wealth effect, coupled with job weakness spreading into higher-income households (not just the lower end).

- A renewed rise in inflation, which would squeeze real purchasing power again.

- A post-refund slowdown later in the year – if spending was merely pulled forward by refunds rather than supported by income.

Conclusion

The lesson of 2025 was clear: never underestimate American resilience. Even when the world feels uncertain, the US consumer is backed by a flexible labour market and a culture that prioritises consumption. While the "hiring freeze" in some sectors is real, we aren't seeing the mass layoffs that usually signal a crash. Instead, we see a consumer that is shopping smarter, not shopping less. In 2025, the U.S. consumer stayed resilient not because everyone was thriving, but because higher-income households kept spending while the lower end felt the strain.

Sources: Bank of America, J.P. Morgan Chase, Reuters, CBS News