For many people, buying or selling a home is one of the most important decisions they will make in their lifetime. There are various factors to consider whether you are the buyer looking for your dream home, or the seller looking to maximise your sales price. Two major considerations which cannot be controlled however, are the state of the market and general sentiment. Below are some observations of the current property market.

At writing, the highest volume of activity is below the R3 million mark, as first-time buyers continue to take advantage of low interest rates. Other buying trends include upscaling, investing, de-urbanisation and semigration for a better quality of life. This is most evident as a significant number of people are moving from Joburg and inland centres to Cape Town and coastal destinations.

The current “new normal” has brought about added challenges for the property market and this is on the back of several years of decline in overall values. Covid-19 has resulted in many life changes amongst buyers, one of the most prominent being a move towards remote working, which allows people the freedom to operate further away from their office. After having spent so much time in our homes during lockdown, buyers are now prioritising living in a home that can offer a higher quality of enjoyment. An interesting result is the relocation to small towns and villages, known as "Zoom Towns". This phenomenon was first observed in the US, but now includes South Africa and other parts of the world. As mentioned above, the pandemic drove people to seek better quality lifestyles in small coastal towns, but still within reach of major cities and/or airports to allow for easy commute access.

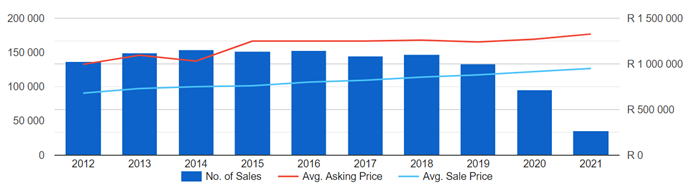

The below charts illustrate the annual number of sales (registered in the deeds office) as well as the average asking and achieved sales price of all Property24 listings for the same time period in South Africa, the Western Cape and Gauteng regions. This shows the elevated asking prices in the Cape versus Gauteng. There seems to be a disproportionately higher value being placed on properties in the Western Cape, with the average sales price trending upward faster than in the Gauteng region. Also noteworthy though is the major reduction in the overall number of sales compared with previous years as a result of the Covid-19 pandemic.

In addition to this, an analysis conducted (according to the FNB Property Barometer) showed that 72% of sellers currently have to drop their initial asking price by an average of 10% in order to achieve a sale. As an example. this translates to as much as R200 000 on a home initially priced at R2 million.

On another note, bullish buyers are still able to snap up luxury properties at significantly discounted levels. The luxury sector performance remains weak, however there has been a 36% increase in activity from 2019 in some areas in the luxury property brackets. Whilst Joburg and Cape Town are brimming with South Africa's wealthier individuals, the latest Africa Wealth Report compiled by wealth intelligence firm New World Wealth and AfrAsia Bank shows the number of wealthy people living around Durban and the North Coast is growing rapidly, as reflected in the table below:

| City | Total wealth ($bn) | HNWIs ($1m+) | Multi-millionaires ($10m+) | Billionaires ($1bn+) |

|---|---|---|---|---|

| Johannesburg | 226 | 15 100 | 790 | 2 |

| Cape Town | 123 | 6 500 | 390 | 1 |

| Cairo | 118 | 7 500 | 400 | 4 |

| Lagos | 88 | 5 000 | 260 | 2 |

| Durban & Umhlanga | 55 | 3 400 | 210 | - |

| Nairobi | 47 | 6 000 | 250 | - |

| Paarl, Franschhoek & Stellenbosch | 47 | 2 800 | 160 | 2 |

| Pretoria | 42 | 2 400 | 100 | - |

| Casablanca | 39 | 2 200 | 110 | 2 |

| Accra | 34 | 2 300 | 100 | - |

In conclusion, if you are going to put your roots down in South Africa, the figures illustrate our property market is offering some of the best value it has in over a decade. However, the longer-term value will depend on the overall economic trajectory of South Africa, which is something that attracts many varied opinions.